37 us banking system diagram

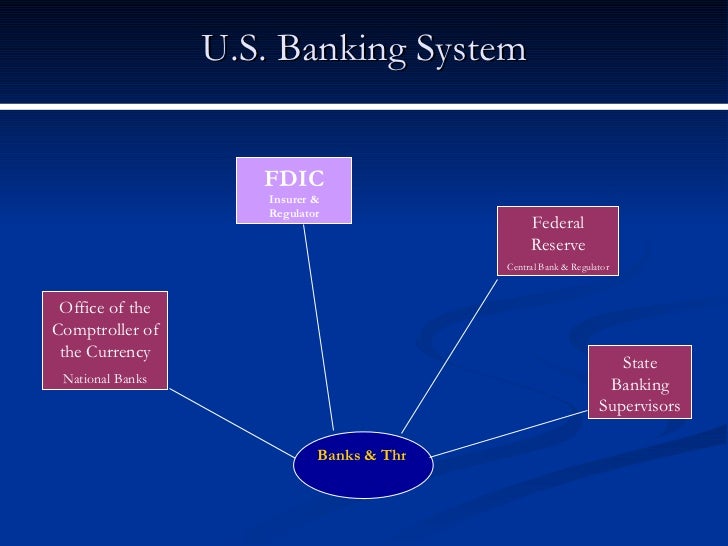

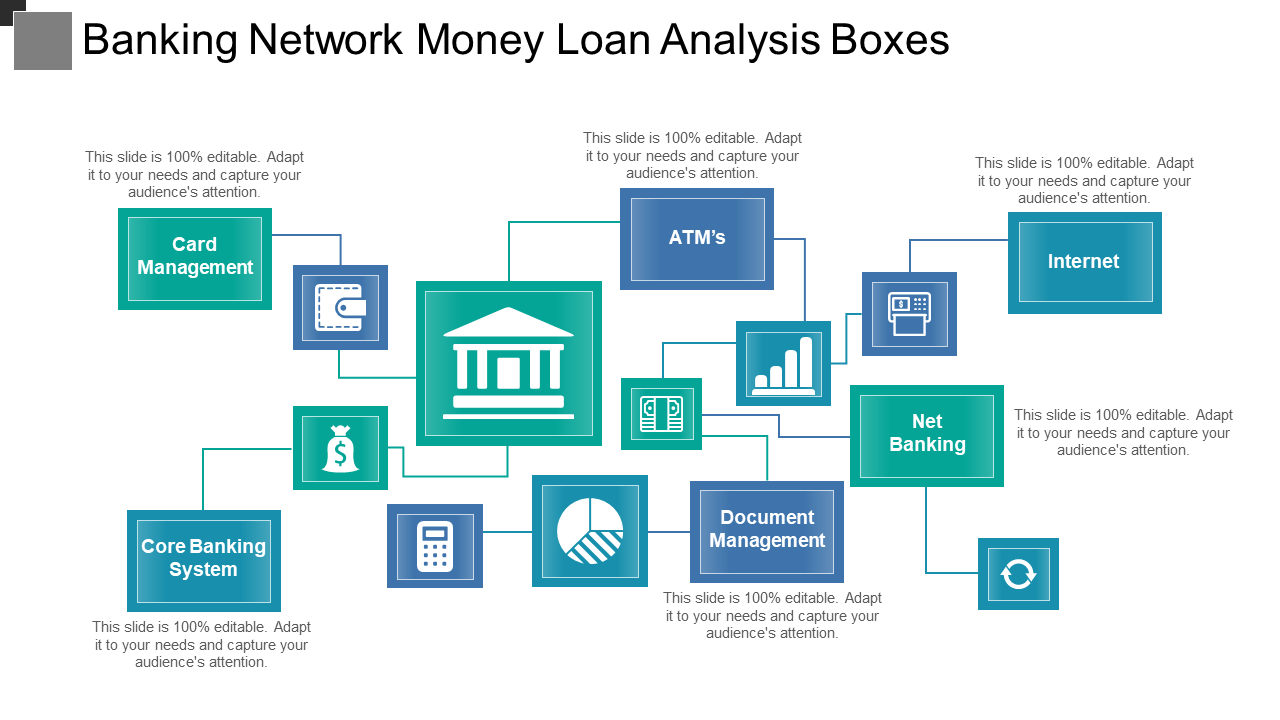

Understanding the US Banking System: How do US banks work? Posted by Rohit Mittal. If Americans don't completely understand the US banking system, imagine how difficult it can be for a foreigner to understand. Unfortunately, the complex system tends to confuse all who come across it. Economics questions and answers. Create a diagram of the U.S. banking system and the Federal Reserve System. Include special financial services of the banking system in your diagram. Be creative in this activity. Pretend you have been asked to teach the structure and interrelationships of the systems to someone else.

Create a diagram of the U.S. banking system and the Federal Reserve System. Include special financial services of the banking system in your diagram. Be creative. Pretend you have been asked to teach the structure and interrelationships of the systems to someone else. Step 2.

Us banking system diagram

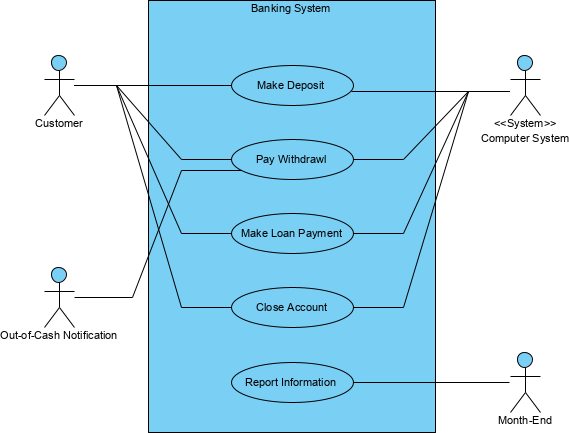

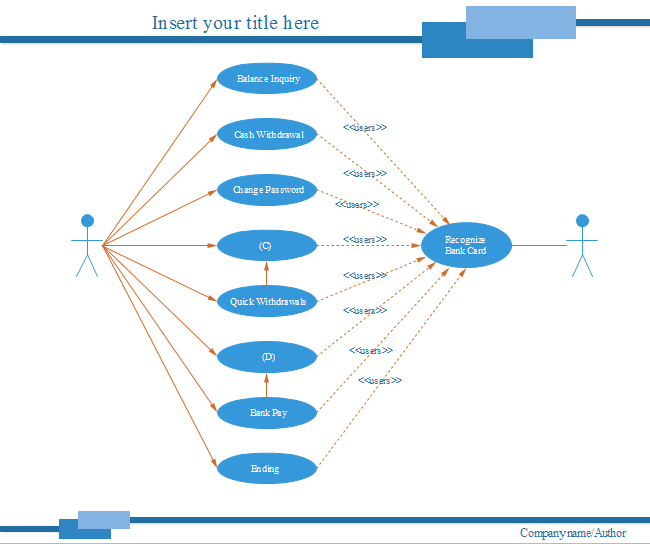

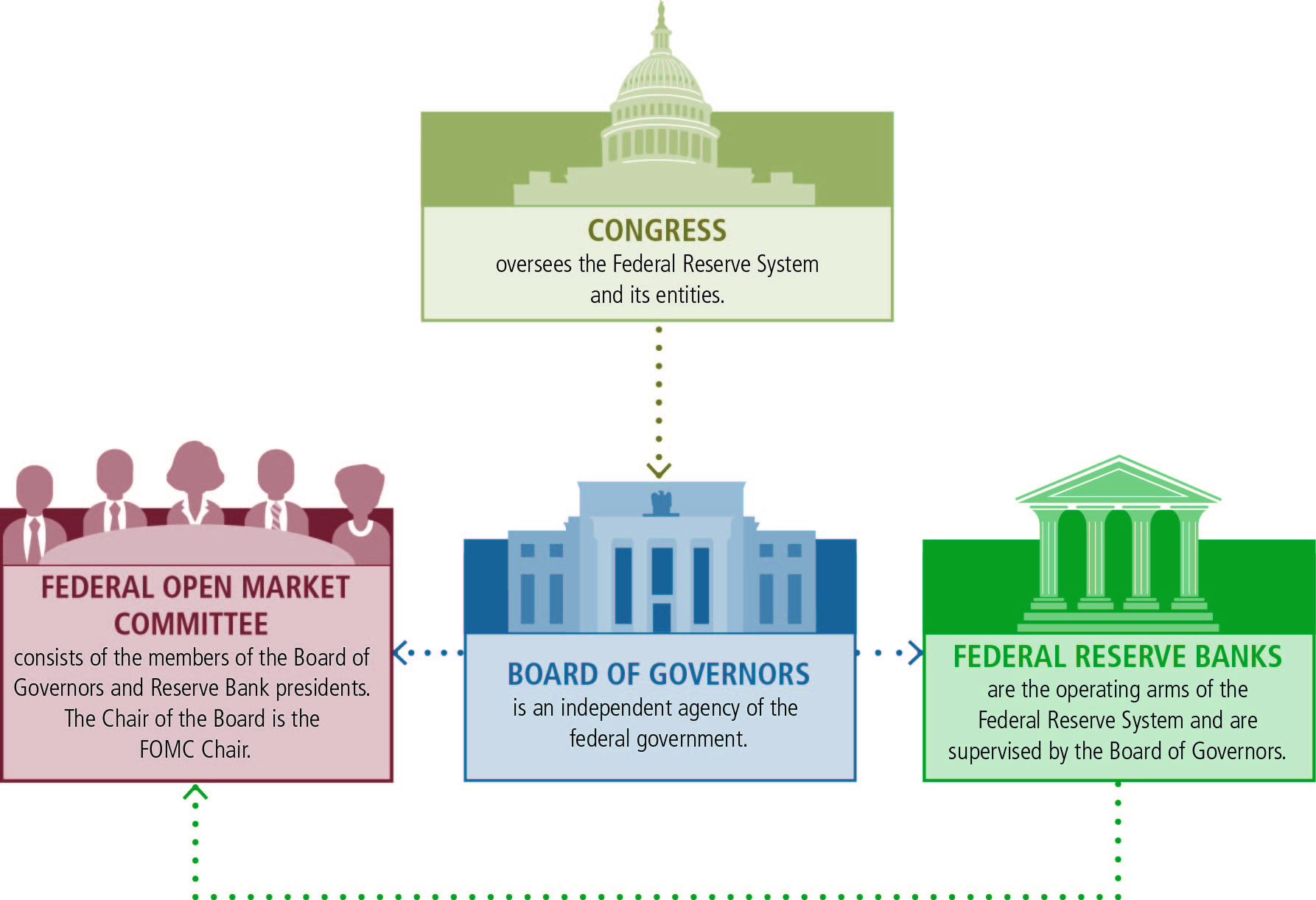

Figure 1 - Use Case diagram for the System Figure 1 illustrates a use case diagram created for this project. It was discovered that the system will have two user groups, the customer and the staff. The customer will primarily use the system to manage their bank account and complete transactions. The United States banking system can seem complicated and confusing. Even many Americans don't completely understand it much of the time. For international students coming into the United States, it can seem downright baffling. This article will attempt to provide you with the basic details about what you need to know to understand the United ... The central banking system of the United States, called the Federal Reserve system, was created in 1913 by the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907. Over time, the roles and responsibilities of the Federal Reserve System have expanded and its structure has evolved.

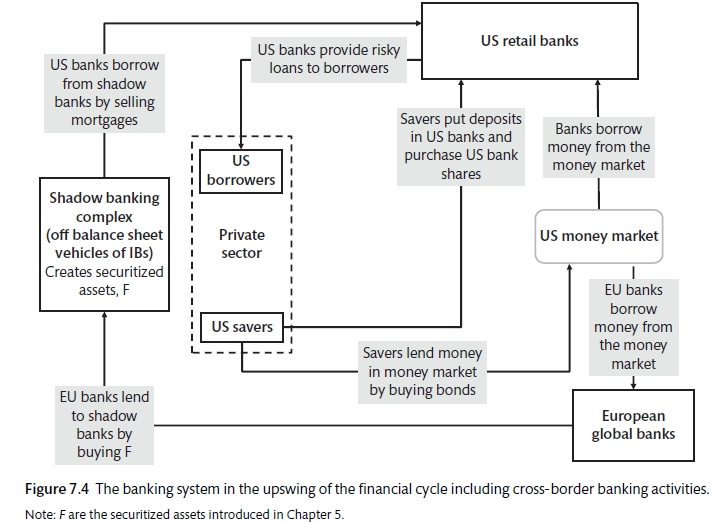

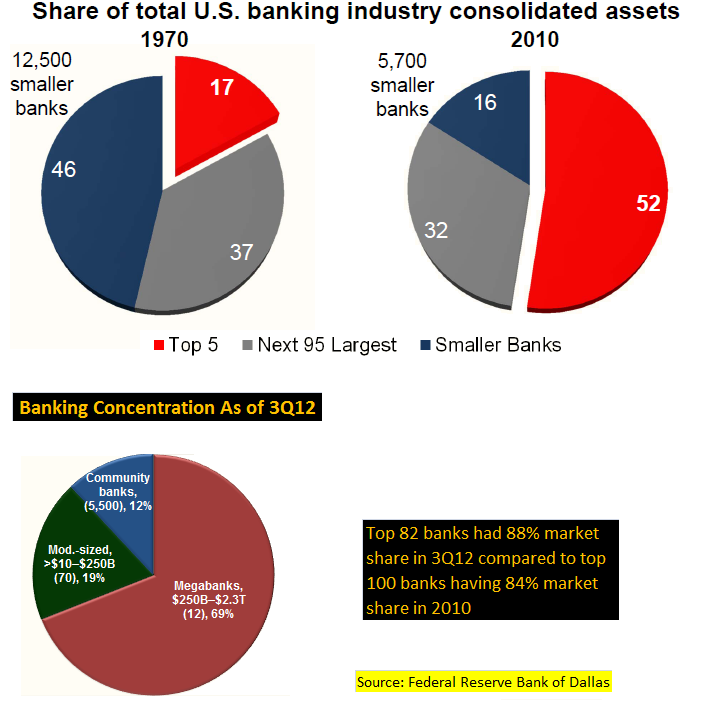

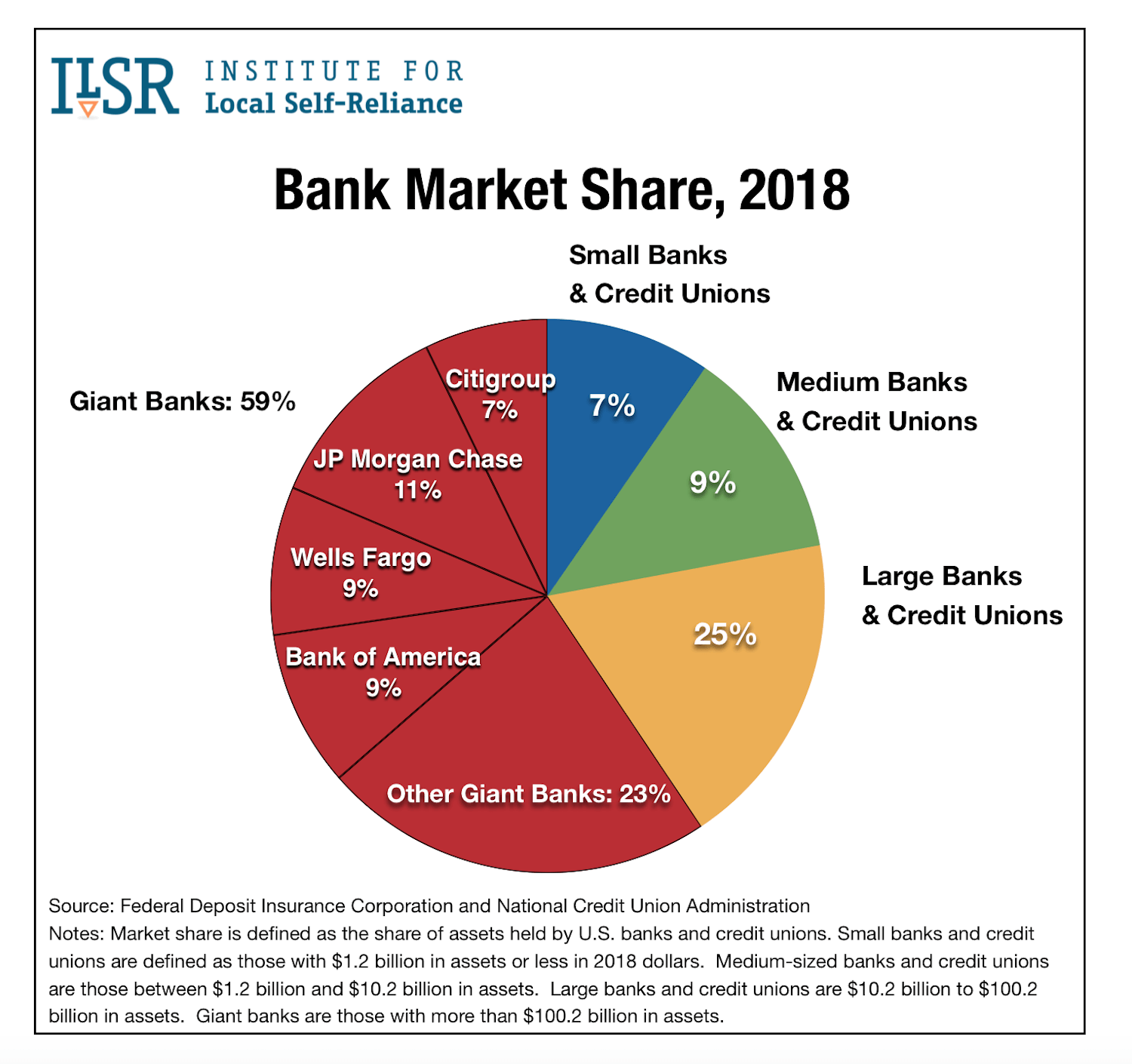

Us banking system diagram. Posted By freeproject on July 24, 2017. This Use Case Diagram is a graphic depiction of the interactions among the elements of Internet Banking. It represents the methodology used in system analysis to identify, clarify, and organize system requirements of Internet Banking. The main actors of Internet Banking in this Use Case Diagram are: Super ... The financial system diagram ... CASH CASH CASH BONDS Commercial paper SHARES CASH CASH CASH BONDS Commercial paper SHARES CASH CASH DEBT OWED TO BANKS BANK DEPOSITS CASH Bank certificates of deposit (CD) CASH CASH CASH SHARES BONDS Money Market Instruments ... For further information about our service please contact us: [email_address] Please ... Federal Reserve System. The Federal Reserve System is also known as the central bank of the United States of America and is claimed to be one of the most powerful financial institutions in the world. It had a uniform national currency and a better banking system than the one before 1863, but it was still prone to financial instability. Banking panics occurred in 1873, 1884, 1893, and 1907. The last was especially embarrassing because by 1907 the US economy was the largest in the world, as was the US banking system.

Definitions Definitions U.S. Banking system Portfolio 1-Consists of a board of governors, a group of reserve banks and member banks 2-Consists of seven members appointed by the U.S. President. They play a large role in controlling the money supply and determine reserve 1) create a diagram of the U.S. banking system and the federal reserve system. include special financial services of the banking system in your diagram. pretend you have been asked to teach the structure and interrelationships of the systems to someone else. 2) list and define all terms contained in the diagram created in step one. Bank system use case diagram template - free download and use. Try building your own use case diagram today. With Edraw, drawing a professional-quality use case diagram is fast, easy and efficient. Discover more UML diagrams and start to make your own. The Federal Reserve Board of Governors in Washington DC. Board of Governors of the Federal Reserve System. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system.

The UML Diagrams are widely used by developers and software engineers for professionally design and development any bank system or Automated Teller Machine (ATM) system. You need a powerful software for their design? ConceptDraw PRO extended with ATM UML Diagrams Solution from the Software Development Area of ConceptDraw Solution Park suits the best for this goal. Create a diagram of the U.S. banking system. 1. Create a diagram of the U.S. banking system and the Federal Reserve System. Include special financial services of the banking system in your diagram. Be creative in this activity. Pretend you have you have been asked to teach the structure and interrelationships of the systems to someone else. 2. US Banking System [classic] Use Creately's easy online diagram editor to edit this diagram, collaborate with others and export results to multiple image formats. You can edit this template and create your own diagram. Creately diagrams can be exported and added to Word, PPT (powerpoint), Excel, Visio or any other document. 1.Create a diagram of the U.S banking system and the Federal Reserve System(FRS). Include special financial services of the banking system in your diagram. Be creative in this activity. Pretend you have been asked to teach the structure and interrelationships of the systems to someone else 2.List and define all terms contained in the diagram ...

This bank ER diagram illustrates key information about bank, including entities such as branches, customers, accounts, and loans. It allows us to understand the relationships between entities. Entities and their Attributes are : Bank Entity : Attributes of Bank Entity are Bank Name, Code and Address. Code is Primary Key for Bank Entity.

View US Banking Portfolio from ENGLISH 105 at Western Oregon University. US BANKING SYSTEM PORTFOLIO MICHELLE GOODWIN Federal Reserve System Central bank of the U.S, which acts as the government's

Very few people understand how the modern banking system really works. They have in their heads a model they learned from text books in which banks take deposits from customers, then lend out ...

U.S. BANK. Federal reserve system- Central bank of the United States, which acts as the government's bank, serves member commercial banks, and controls the nation's money supply. Bank- An establishment for the custody, loan, exchange, or issue of money, for the extension of credit, and for facilitating the transmission of funds.

About the Federal Reserve System. The Federal Reserve System is the central bank of the United States. It performs five general functions to promote the effective operation of the U.S. economy and, more generally, the public interest.

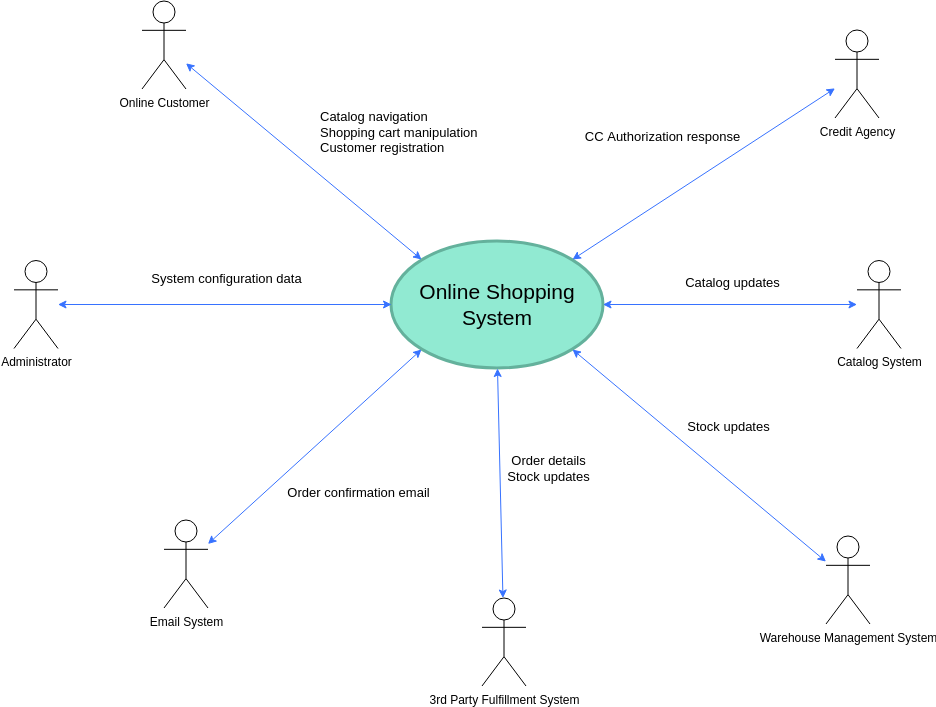

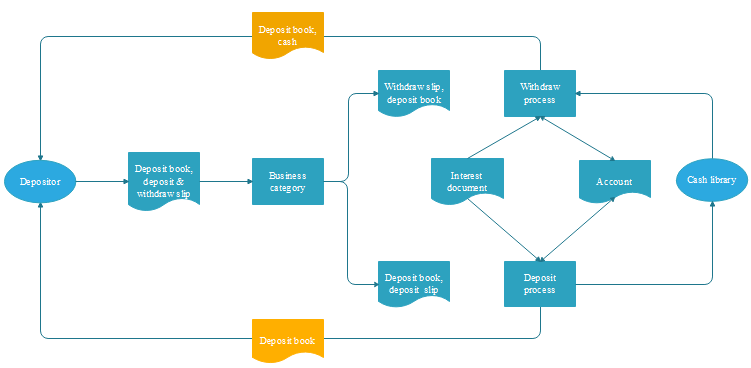

The Bank has the access to modify the Loan Management System as the Bank can set or modify any policies of the Loan offered by the Bank. Online Banking System - It provides other services like insurance, bill payments, etc. The Level-2 Data Flow Diagram of an Online Banking System is as follows -

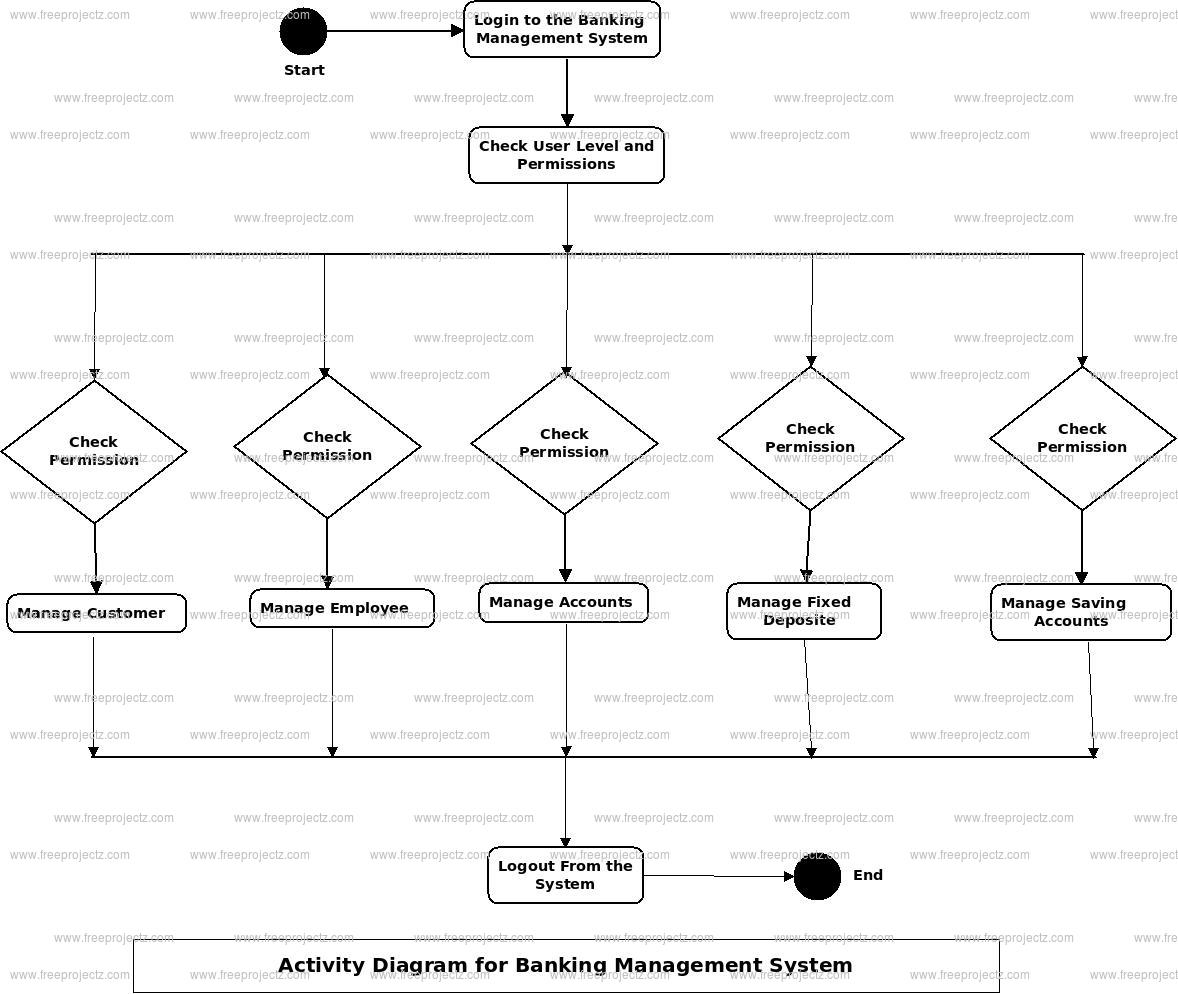

Login Activity Diagram of Banking Management System: This is the Login Activity Diagram of Banking Management System, which shows the flows of Login Activity, where admin will be able to login using their username and password.After login user can manage all the operations on Customer, Balance, Accounts, Fixed Deposit, Employees.

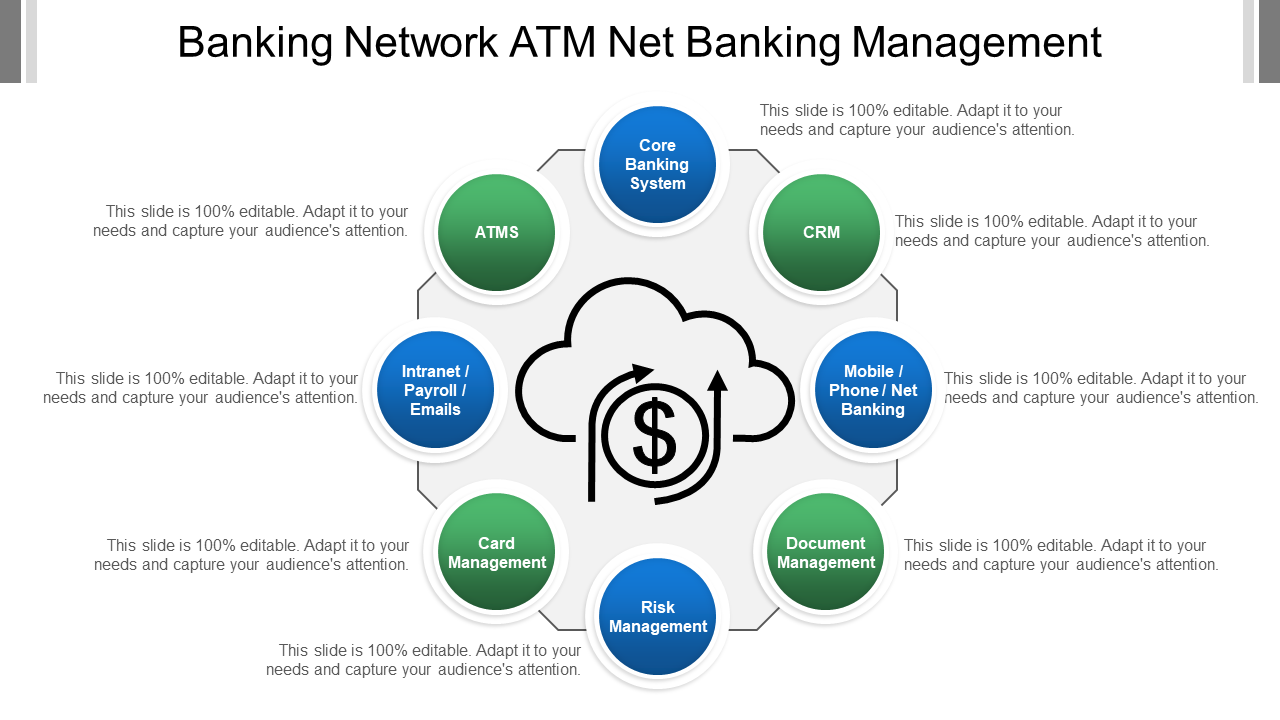

ConceptDraw PRO extended with ATM UML Diagrams Solution from the Software Development Area of ConceptDraw Solution Park is a powerful software for representing the ATM processes, for designing and building banking system and ATMs. Diagram For Banking System

The Structure and Functions of the Federal Reserve System. The Federal Reserve System is the central bank of the United States. It was founded by Congress in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system. Over the years, its role in banking and the economy has expanded.

1.Create a diagram of the U.S banking system and the Federal Reserve System (FRS). Include special financial services of the banking system in your diagram. Be creative in this activity. Pretend you have been asked to teach the structure and interrelationships of the systems to someone else. 2.List and define all terms contained in the diagram ...

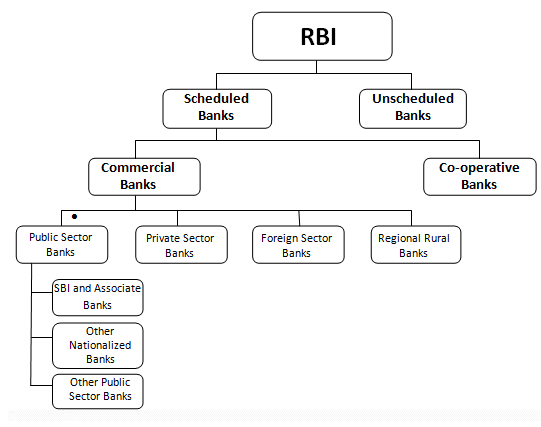

A class diagram models the static view of a system. It comprises of the classes, interfaces, and collaborations of a system; and the relationships between them. Class Diagram of a System. Let us consider a simplified Banking System. A bank has many branches.

The central banking system of the United States, called the Federal Reserve system, was created in 1913 by the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907. Over time, the roles and responsibilities of the Federal Reserve System have expanded and its structure has evolved.

The United States banking system can seem complicated and confusing. Even many Americans don't completely understand it much of the time. For international students coming into the United States, it can seem downright baffling. This article will attempt to provide you with the basic details about what you need to know to understand the United ...

Figure 1 - Use Case diagram for the System Figure 1 illustrates a use case diagram created for this project. It was discovered that the system will have two user groups, the customer and the staff. The customer will primarily use the system to manage their bank account and complete transactions.

:max_bytes(150000):strip_icc()/TakeaDeeperLookatNationalPaymentSystems2-68d337130cca411494d31b60c8d63fae.png)

0 Response to "37 us banking system diagram"

Post a Comment