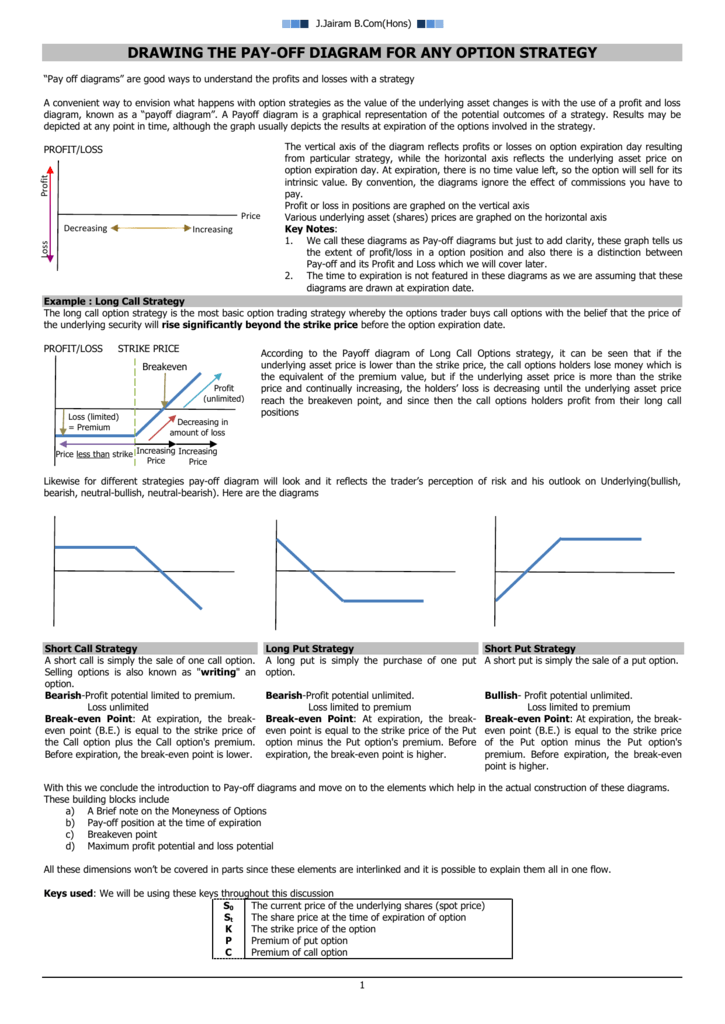

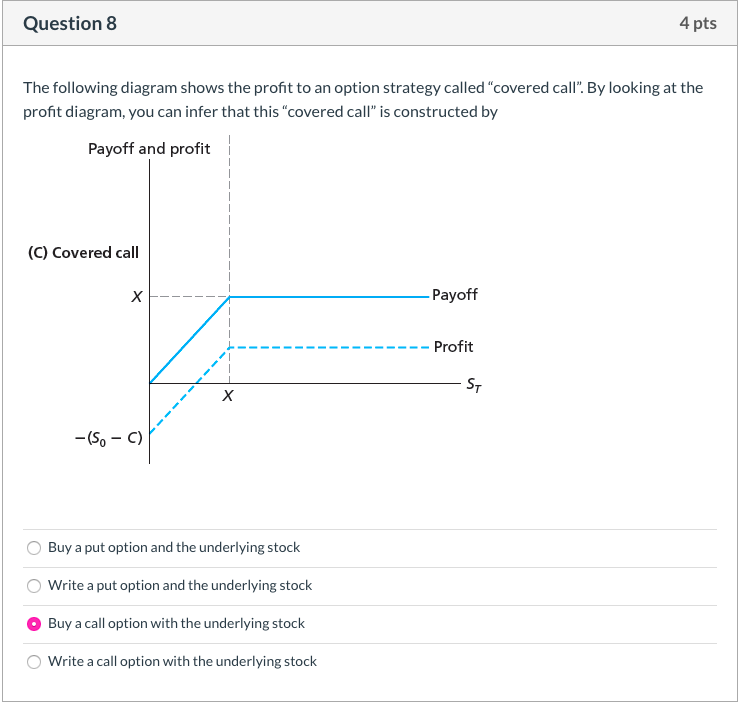

39 covered call payoff diagram

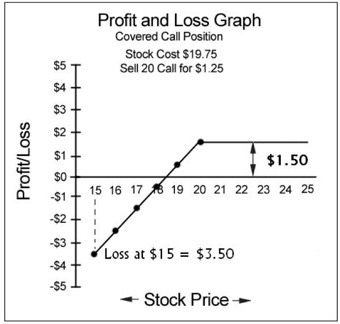

A covered call is a risk management and an options strategy that involves holding a long position in the underlying asset (e.g., stock Stock What is a stock? An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). With our above argument, we can view this strategy as a limited profit with no downside risk but unlimited upside risk. The Payoff of the diagram of the covered put option is shown in image-1. Example. Let’s assume that Mr. XYZ has written a covered put option on BOB stock with a strike price of $70/- for one month for a premium of $5/-.

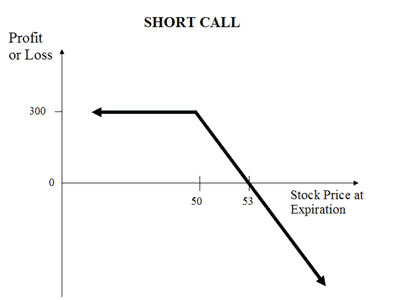

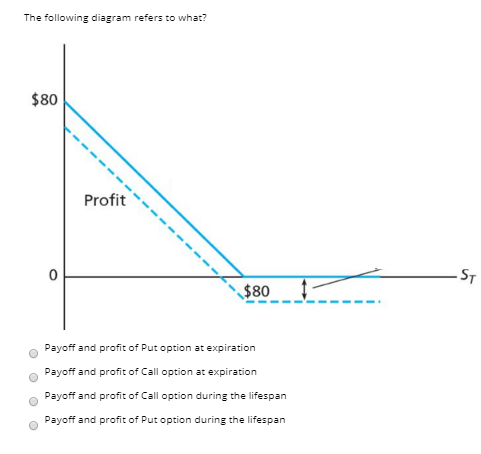

Feb 06, 2017 · Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium.

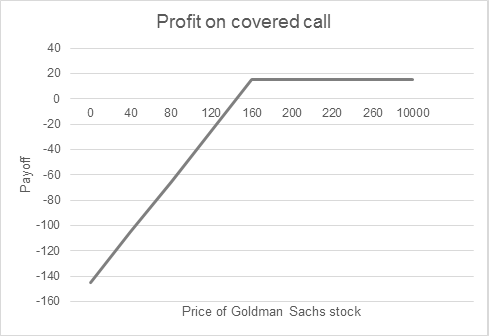

Covered call payoff diagram

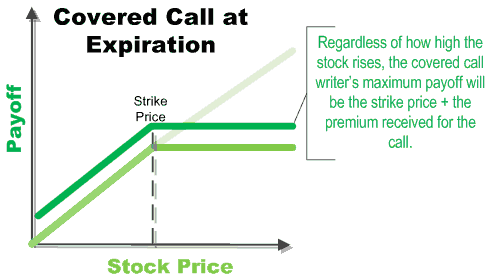

Aug 25, 2018 · Looking at a payoff diagram for a strategy, we get a clear picture of how the strategy may perform at various expiry prices. By seeing the payoff diagram of a call option, we can understand at a glance that if the price of underlying on expiry is lower than the strike price, the call options holders will lose money equal to the premium paid, but if the underlying asset price is more than the ... The payoff will also be flat here. Below we can see what the payoff diagram of a collar would look like. Collar Option Payoff Diagram. The payoff of a collar can be understood through the use of a payoff diagram. By plotting the payoff for the underlying asset, long put option, and short call option we can see what the collar position payoff ... Covered call is just opposite to naked call, which is a strategy in which the option writer writes a call option without having any covering position in the underlying asset. Investors write covered calls when they expect the price of the underlying stock to rise but stay below the exercise price (also called strike price).

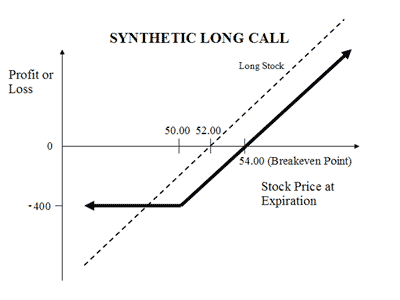

Covered call payoff diagram. This page explains call option payoff / profit or loss at expiration. We will look at: A call option’s payoff diagram; All the things that can happen when you are long a call option, and your profit or loss under each scenario; Exact formulas to calculate a call option’s payoff; Calculation of call option payoff in Excel; Calculation of a call option position’s break-even point (the ... This page explains put option payoff. We will look at: A put option’s payoff diagram; All the things that can happen with a long put option position, and your profit or loss under each scenario; Exact formulas to calculate put option payoff; Calculation of put option payoff in Excel; Calculation of a put option position’s break-even point (the exact price where it starts to be profitable) The payoff diagram for purchasing a single-leg LEAPS contract will resemble the same profit and loss potential as a long call or long put option. The risk is limited to the initial debit paid at entry and profit potential is unlimited. Call Option Payoff Diagram So when trading the YHOO $40 call, we paid $200 for the contract and sold it at $1,000 for a $800 profit on a $200 investment--that's a 400% return. In the example of buying the 100 shares of YHOO we had $4,000 to spend, so what would have happened if we spent that $4,000 on buying more than one YHOO call option ...

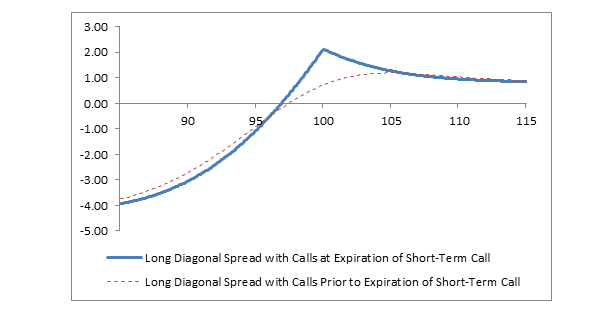

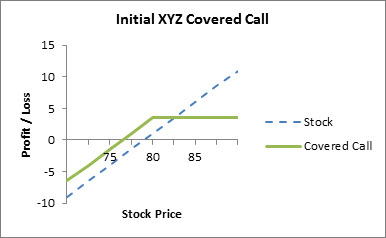

The payoff diagram for a put calendar spread is variable and has many different outcomes depending on when the options trader decides to exit the position. The maximum risk is defined at entry by the debit paid to enter the spread if both options are exited at the first expiration. Covered Calls. The covered call is a strategy in options trading whereby call options are written against a holding of the underlying security. Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting ... Long Call Payoff Diagram. 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account. ... As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. In place of holding the underlying stock in the ... The below covered call option payoff is from Interactive Brokers. The covered call option was an AAPL 110 strike call sold for $4.20 per contract or $420 in total and a long position bought at $106.10 per share. The breakeven price at expiration is $101.90 (long position bought price minus premium received).

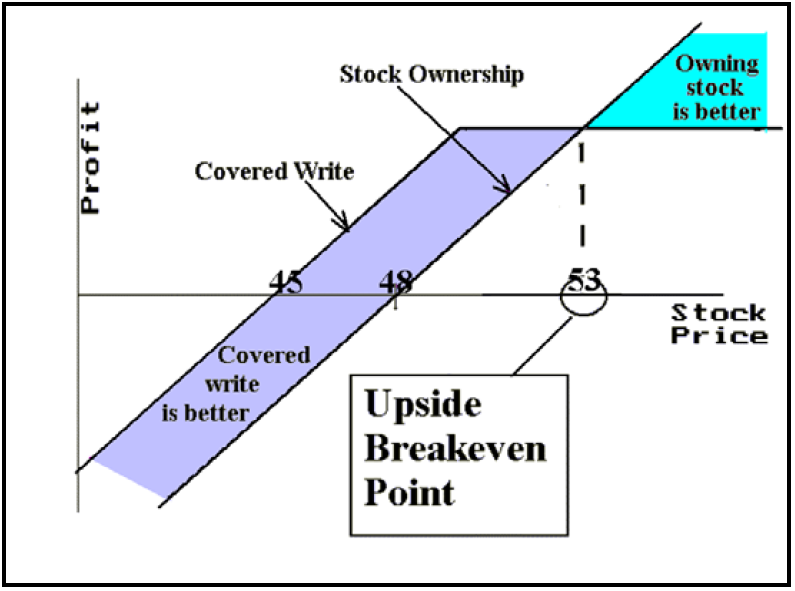

Covered call is an options strategy that combines owning the underlying asset, along with an options contract on the underlying.. The trader holds a long position in a security and at the same time, he writes the call option on the same security to generate income through premiums.. Covered Call Strategy. The covered call strategy works well when the trader is mildly bullish towards the market. Payoff graphs can be made identical by adding a zero-coupon bond to the purchased put Covered call writing Long Position in Asset + Sell a Call Option Long Index Payoff + {-max[0, S T – K] + FV(P C)} Graph similar to that of a written put Covered put writing Short Position in Asset + Write a Put Option - Long Index Payoff + {-max[0, K - S T ... Covered calls usually have maximum profit much smaller than maximum loss, due to the possibility of underlying price dropping to zero and the upside capped at the call strike. Payoff Diagrams. The chart in the middle of the Main sheet can display payoff diagram for the entire covered call, as well as individual legs. The idea behind a Covered Call (also called Covered Write) is to hold stock over a long period of time and every month or so sell out-of-the-money call options. Even though the payoff diagram shows an unlimited loss potential, you must remember that many investors implementing this type of strategy have bought the stock long ago and hence the ...

Covered call is just opposite to naked call, which is a strategy in which the option writer writes a call option without having any covering position in the underlying asset. Investors write covered calls when they expect the price of the underlying stock to rise but stay below the exercise price (also called strike price).

The payoff will also be flat here. Below we can see what the payoff diagram of a collar would look like. Collar Option Payoff Diagram. The payoff of a collar can be understood through the use of a payoff diagram. By plotting the payoff for the underlying asset, long put option, and short call option we can see what the collar position payoff ...

Aug 25, 2018 · Looking at a payoff diagram for a strategy, we get a clear picture of how the strategy may perform at various expiry prices. By seeing the payoff diagram of a call option, we can understand at a glance that if the price of underlying on expiry is lower than the strike price, the call options holders will lose money equal to the premium paid, but if the underlying asset price is more than the ...

Can You Day Trade With Robenhood Expected Return And Risk Of Covered Call Strategies Earthlink Technologies

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

0 Response to "39 covered call payoff diagram"

Post a Comment