40 private equity fund structure diagram

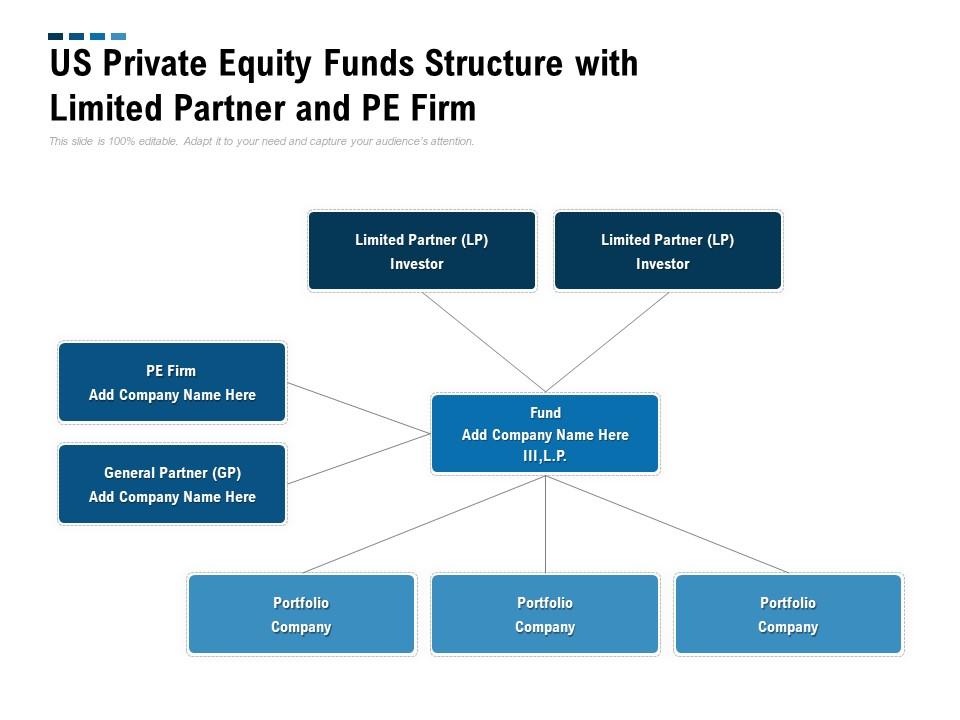

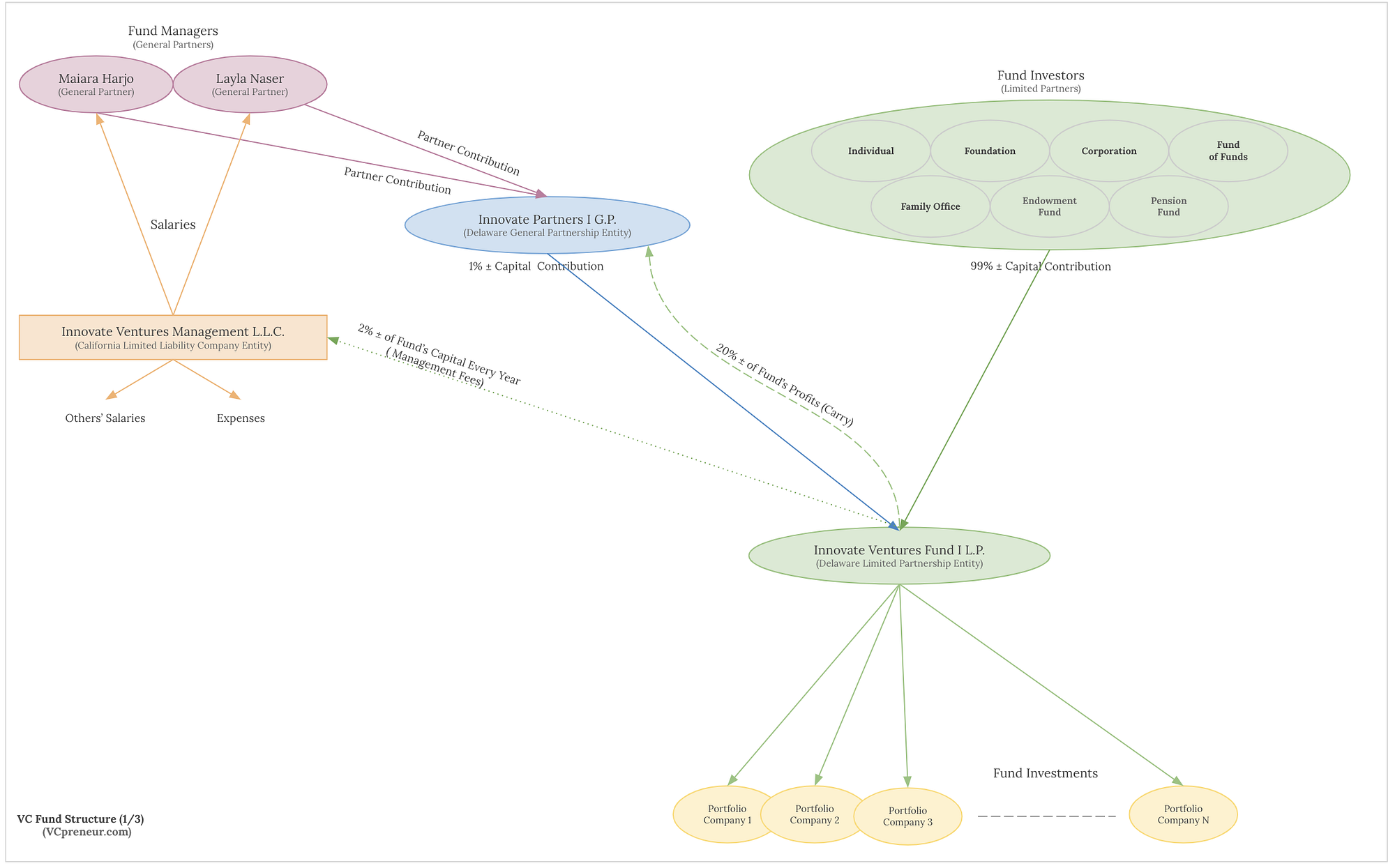

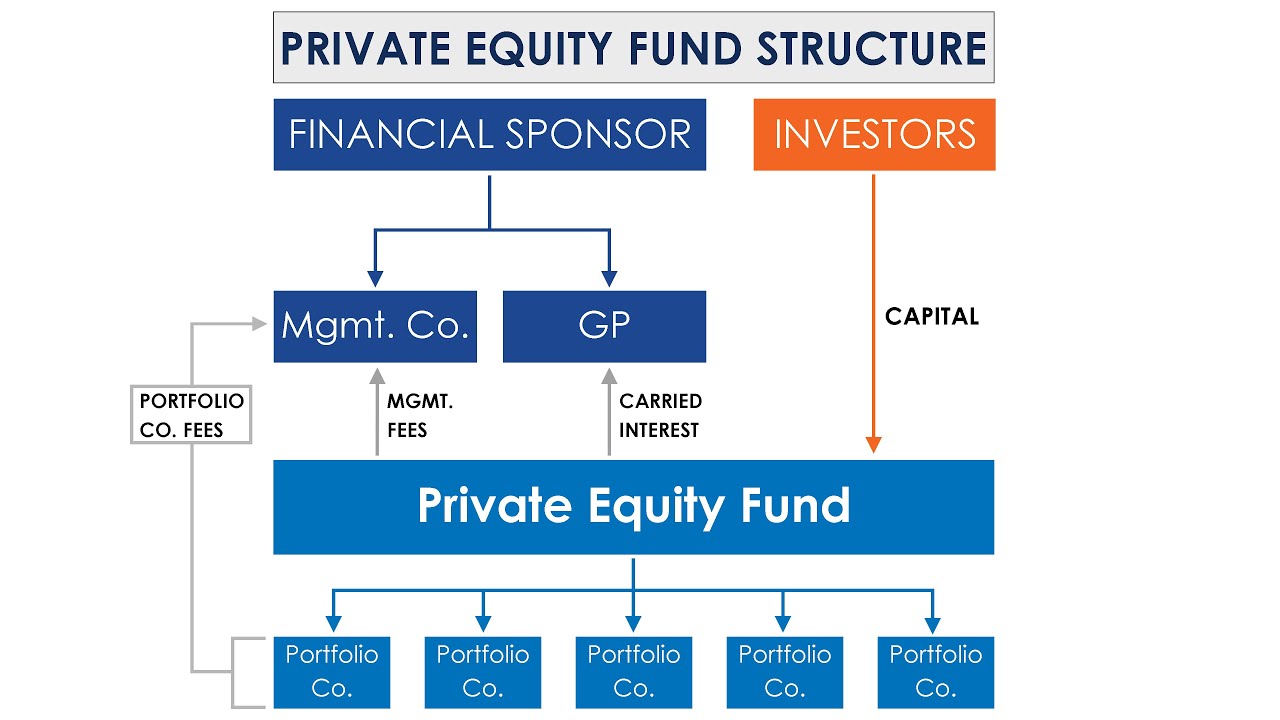

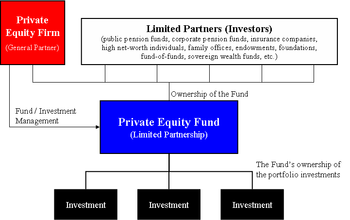

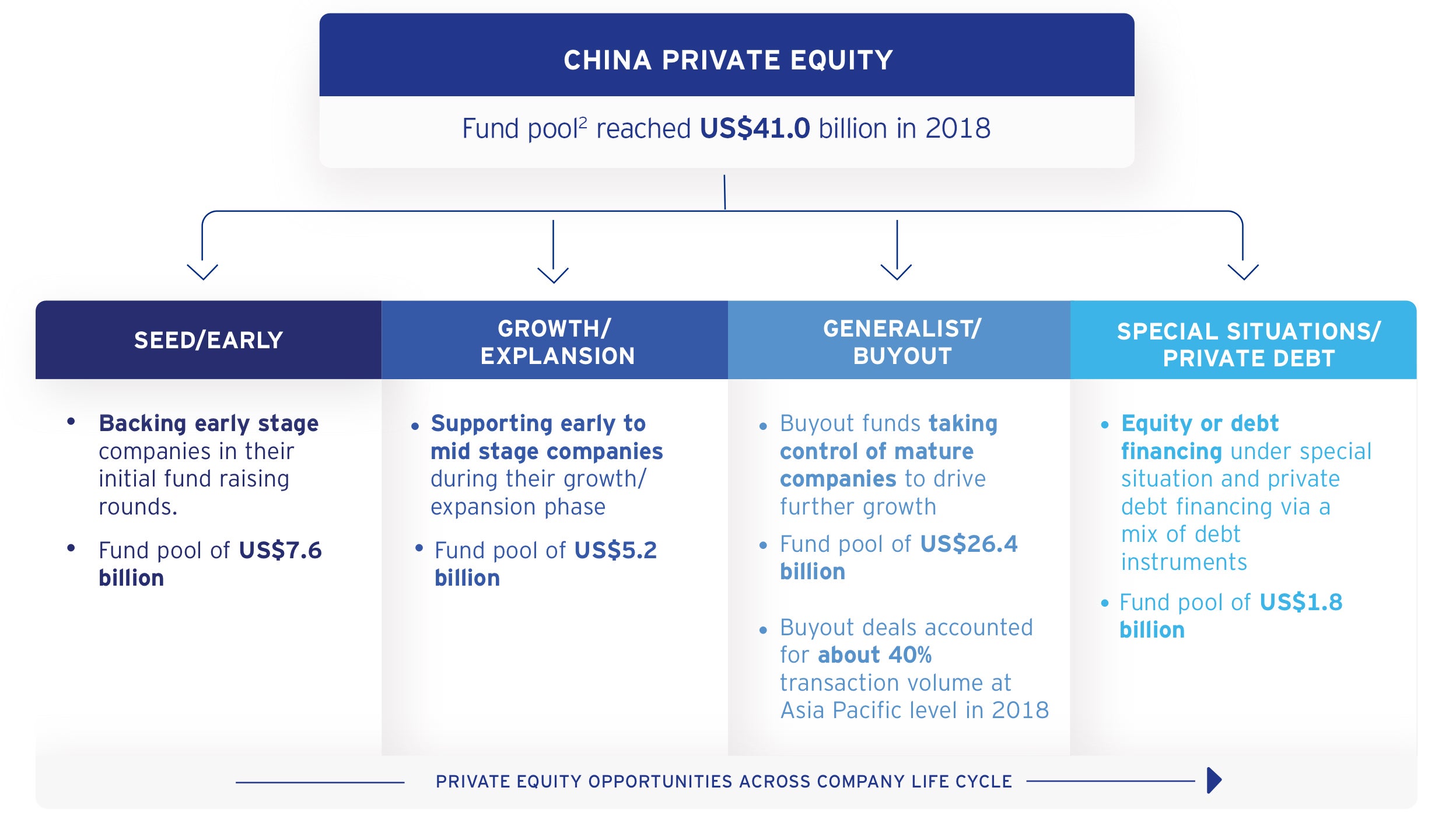

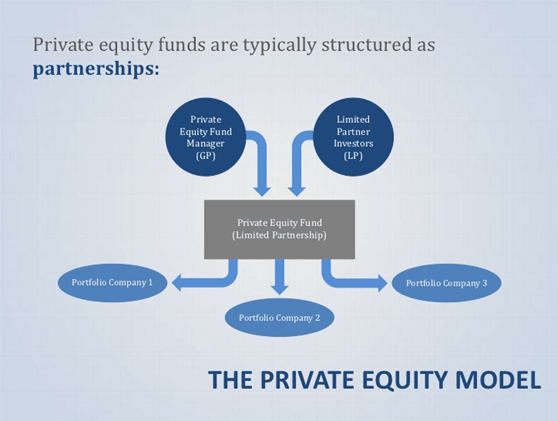

Private equity funds are closed-end funds that are considered an alternative investment class. Because they are private, their capital is not listed on a public exchange. These funds allow high-net-worth individualsand a variety of institutions to directly invest in and acquire equity ownership in companies. Funds may consider purchasing stakes in private firms or public companies with the intention of de-listing the latter from public stock exchanges to take them private. After a certain period of time, the private equity fund generally divests its holdings through a number of options, including initial public offerings(IPOs) or sales to other private equity firms. Although minimum investments vary for each fund, the structure of private equity funds historically follows a similar framework that includes classes of fund partners, management fees, investment horizons, and other key factors laid out in a limited partnershipagreement (LPA). For the most part, private equity funds have... Private equity firms are structured as partnerships with one GP making the investments and several LPs investing capital. All institutional partners of the fund will agree on set terms laid out in a Limited Partnership Agreement (LPA). Some LPs may also ask for special terms outlined in a side letter.

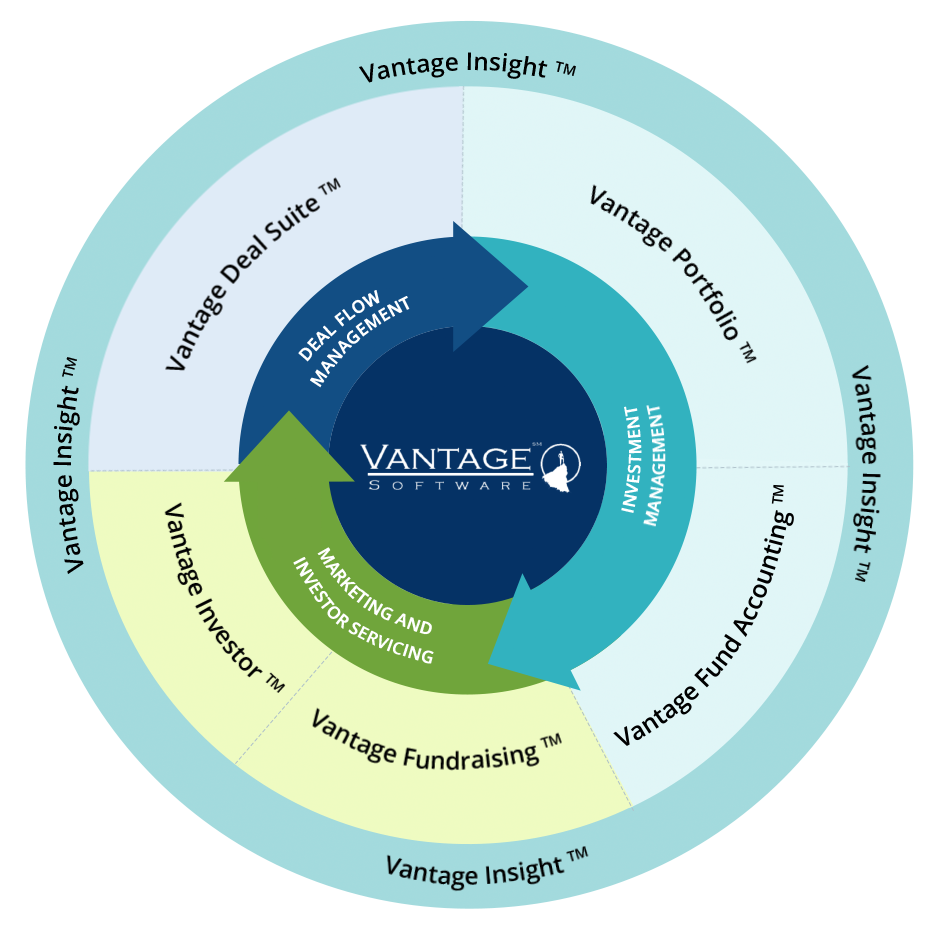

As engineers of some of the earliest innovative instruments being used by investment funds (both private equity and venture capital) in India we proactively spend time in developing an advanced under-standing of the industry as well as the current legal, regulatory and tax regime. Choice of Fund Vehicle Structure follows strategy, and not vice ...

Private equity fund structure diagram

advising private equity, growth equity, and venture capital funds and their portfolio companies in a wide variety of transactions including leveraged buyouts, recapitalizations, M&A, and growth-equity financings. A blocker corporation is sometimes used by a PE or VC fund to invest in an LLC or partnership. Goodwin Procter's John LeClaire and ... 3 A good description of real estate private equity fund structure can be found in Andrae Kuzmicki and Daniel Simunac, “Private Equity Real Estate Funds: An Institutional Perspective,” Real Property Association of Canada, 2008. organisation allocates to 87 private equity funds and is on the LPAC for 86 out of 87 of these funds. No LP interviewed for this study said that they would consider making an allocation to a private equity fund unless there is a LPAC in place. And a number of these admitted to agitating for a place on the committee.

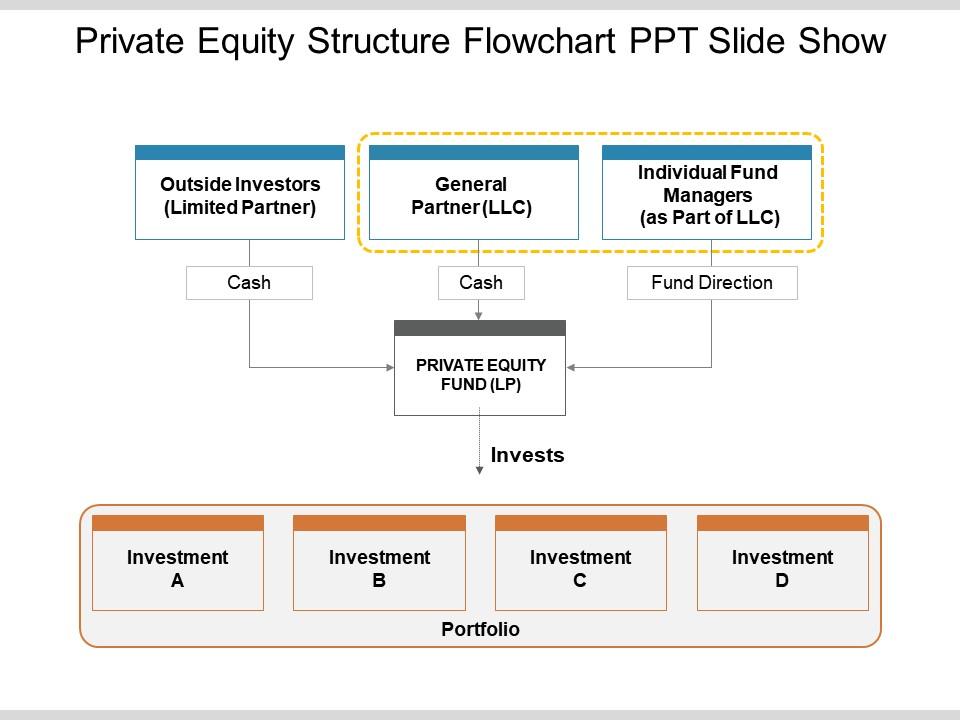

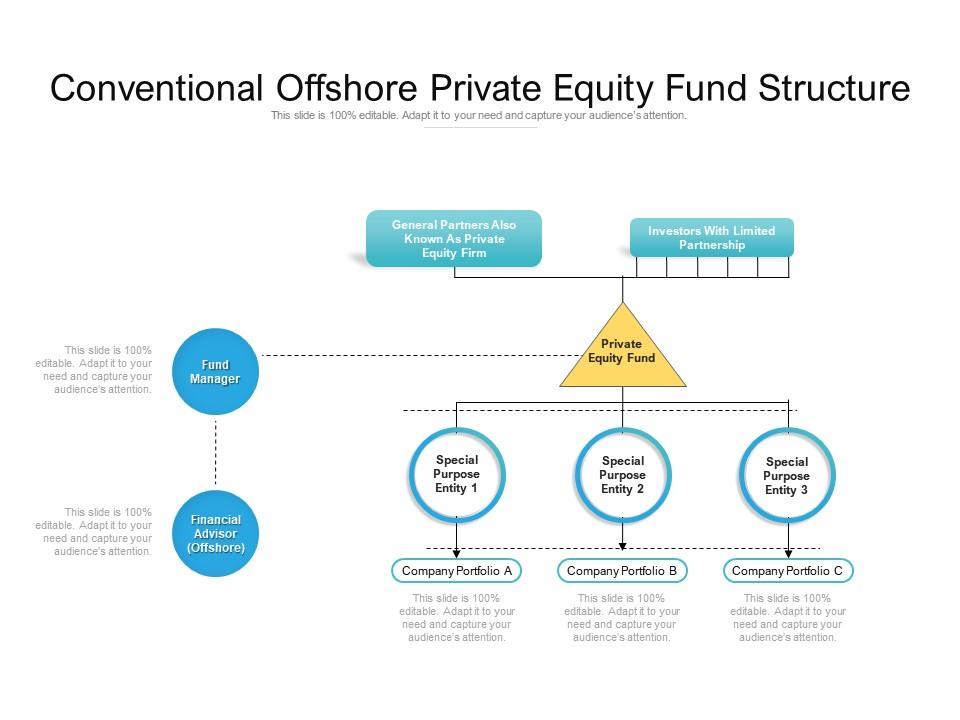

Private equity fund structure diagram. Many private equity fund agreements contain a provision permitting, or under certain circumstances ... fund, modified only to reflect the AIV structure itself and for changes necessitated by legal differences between the vehicles (e.g., Cayman Islands law will govern a Cayman Islands limited partnership). Jun 03, 2017 · This post introduces the typical private equity fund structure that's used in the United States - the limited partnership. Basic Limited Partnership Structure In a basic limited partnership, there are several passive investors (known as " Limited Partners " or " LPs ") and the manager of the fund, (known as the " General Partner " or " GP "). The goal of a private equity investment structure is to align the interests of the various parties who invest in an individual deal or a private equity fund. Private equity waterfalls can take different forms based on each party's goals as well as ensuring the other stakeholder has the correct incentives in the investment along with the other ... These funds are generally formed as either a Limited Partnership (“LP”) or Limited Liability Company (“LLC”). The advantages of these structures for a private equity fund are as follows: 1) Perhaps the biggest advantage for investors is that they are exposed to limited liability. If anything goes wrong in the investment process (bankruptcy, lawsuits, etc.), the investor risks only the capital they have committed.

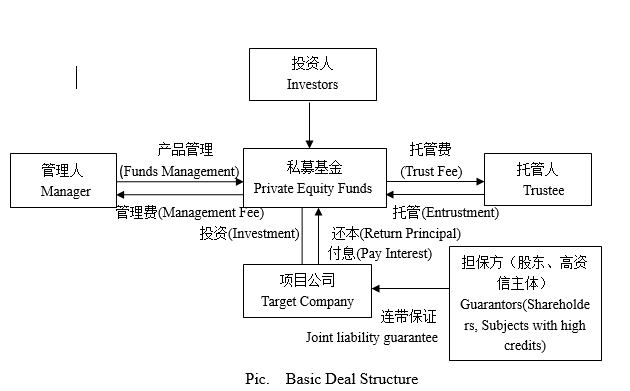

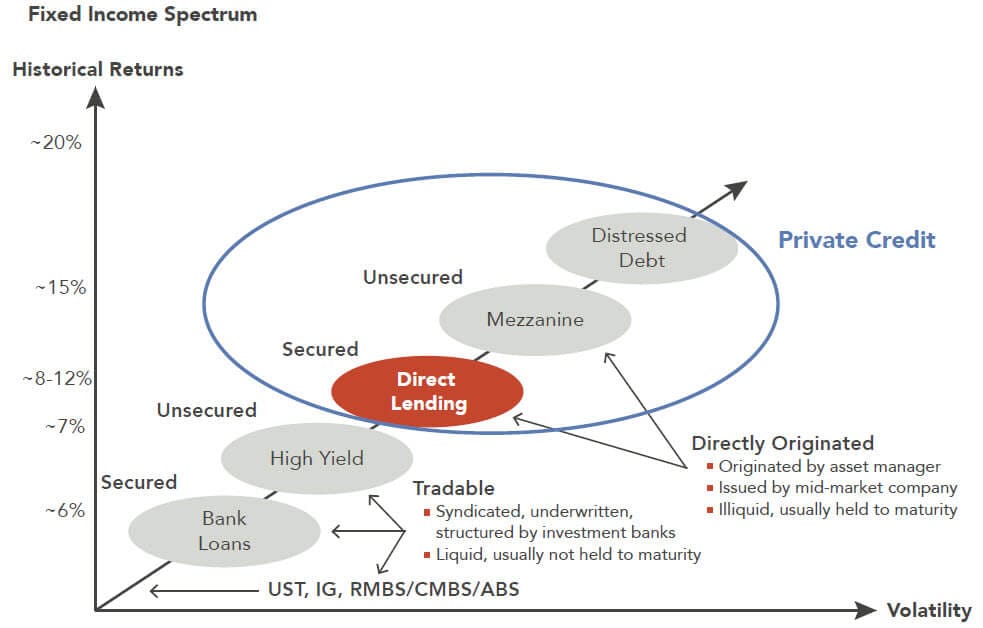

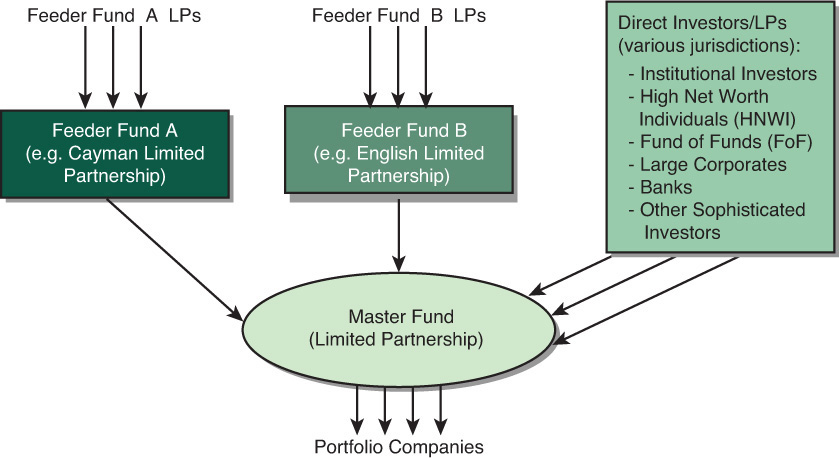

What is a Master-Feeder Structure? A master-feeder structure is an investment structure used by hedge funds Hedge Fund A hedge fund, an alternative investment vehicle, is a partnership where investors (accredited investors or institutional investors) pool under which multiple investors invest in onshore and offshore "feeder" funds, which, in turn, invest in a larger "master" fund. on the distinction between hedge funds and private equity funds, see Box, Distinguishing Hedge Funds From Private Equity Funds). GENERAL FUND STRUCTURE The structure of a private equity fund generally involves several key entities, as follows: "!The investment fund, which is a pure pool of capital with no direct operations. 32 Private Equity Fund Structure Diagram - Free Wiring Diagram Source. Taxation of private equity and hedge funds - Wikipedia. Fund Structure of Private Equity and Venture Capitalists - FinanciaL ... Fund Structure. Stages ? 'Stages' here means the number of divisions or graphic elements in the slide. For example, if you want a 4 piece puzzle slide, you can search for the word 'puzzles' and then select 4 'Stages' here. We have categorized all our content according to the number of 'Stages' to make it easier for you to refine ...

Diagram of the structure of a generic private-equity fund Most private-equity funds are structured as limited partnerships and are governed by the terms set forth in the limited partnership agreement or LPA. Please note: This is a simplified illustration and explanation of three structures that can be used for investment funds. These diagrams do not illustrate all of the entities involved in forming, operating, or managing a fund. This diagram does not provide a definitive illustration of any particular fund structure, any guidance on, A general partner General Partner A general partner (GP) refers to the private equity firm responsible for managing a private equity fund. The private equity firm acts as a GP, and the external investors are limited partners (LPs). read more contributes 1-3% of the total investment and handles the fund's management as a manager. The equity invested in this vehicle will invest in the equity of the companies it owns and ultimately own 100% of equity in the Target company. Equity investments in Topco will be comparatively a small amount of ordinary shares, with the majority of the fund’s investment being made in the form of loan notes or preference shares in the Newco ...

Most venture and private equity funds use a limited partnership as their legal structure (Figure 2), which involves two main types of actors: (1) a general partner (GP) and (2) limited partners (LPs).

1. ‘Sourcing’ and ‘Teasers’ The beginning of the private equity deal structure is called ‘deal sourcing.’Sourcing involves discovering and assessing an investment opportunity. PE deals are sourced through various methods such as research, internal analysis, networking, cold-calling executives of target companies, business meetings, screening for certain criteria, conferences and ...

Jan 20, 2020 · Private Equity Fund structure – Trust. A Private Equity that is structured as a Unit Trust is a type of collective investment governed by a trust deed. The investors are usually the main beneficiaries of the Trust. The Fund’s Net Asset Value (NAV) divided by the number of units outstanding determines the price of each unit of the Trust.

Download scientific diagram | Islamic Private Equity Fund Structure from publication: A Conceptual Framework for the Application of Islamic Private Equity in International Shipping | This paper ...

Offer helpful instructions and related details about Private Equity Firm Structure Diagram - make it easier for users to find business information than ever. Top Companies. Top Us Private Equity Firms Top Pe Firms In Us Top Middle Market Pe Firms ...

Private Equity Fund Structure Peter Lynch Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. These funds are generally formed as either a Limited Partnership (“LP”) or Limited Liability Company (“LLC”).

STARTING A PRIVATE EQUITY FUND STRUCTURE & INVESTMENT TERMS Call 212.203.4300 for a free consultation STRUCTURE Closed-End Structure Private equity funds are almost always closed-end funds. A closed-end fund is an investment fund intended to last for a fixed term. A private equity fund’s term is usually between five to ten years.

Download scientific diagram | 1-Private Equity Fund Structure from publication: The Patterns of Private Equity Investment in Ireland, 2007 - 2014 | Abstract Over the last decade developments of ...

Offer helpful instructions and related details about Private Equity Management Company Structure - make it easier for users to find business information than ever. Top Companies. Modern Healthcare Top Consulting Firms Top Consulting Firms In Us Top Consulting Firms In The World ...

Fund Blocker Corporation Structures Where a private equity fund invests in a flow-through portfolio company engaged in a U.S. business (i.e., a portfolio company organized as a partnership or LLC), certain tax-sensitive fund LPs — virtually all non-U.S. LPs and many U.S. tax-exempt LPs —

Private Investment Funds Practice attorney. About Morgan Lewis’s Private Investment Funds Practice Morgan Lewis has one of the nation’s largest private investment fund practices and is consistently ranked as the “#1Most Active Law Firm” globally based on the number of funds worked on for limited partners by Dow Jones Private Equity Analyst.

organisation allocates to 87 private equity funds and is on the LPAC for 86 out of 87 of these funds. No LP interviewed for this study said that they would consider making an allocation to a private equity fund unless there is a LPAC in place. And a number of these admitted to agitating for a place on the committee.

3 A good description of real estate private equity fund structure can be found in Andrae Kuzmicki and Daniel Simunac, “Private Equity Real Estate Funds: An Institutional Perspective,” Real Property Association of Canada, 2008.

advising private equity, growth equity, and venture capital funds and their portfolio companies in a wide variety of transactions including leveraged buyouts, recapitalizations, M&A, and growth-equity financings. A blocker corporation is sometimes used by a PE or VC fund to invest in an LLC or partnership. Goodwin Procter's John LeClaire and ...

0 Response to "40 private equity fund structure diagram"

Post a Comment