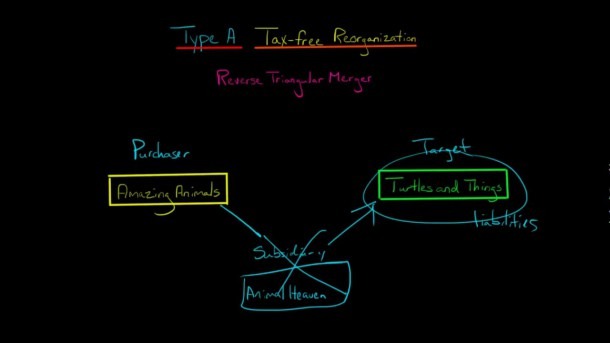

41 reverse triangular merger diagram

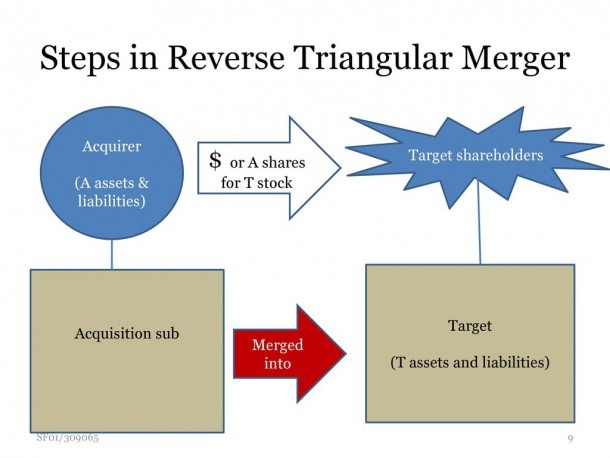

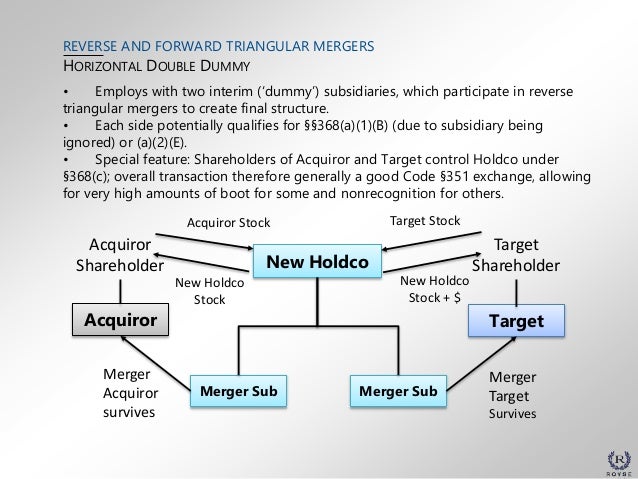

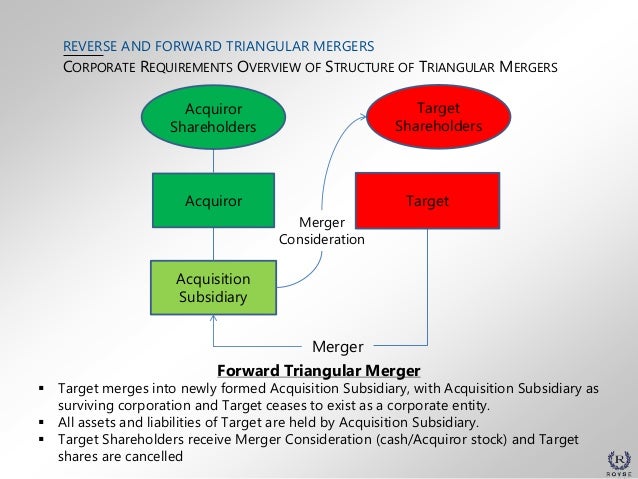

Forward Triangular Merger: §368(a)(2)(D) Section 368 Acquisitions - Triangular Reorg Reverse triangular merger (acquirer forms wholly-owned shell corporation, shell corporation merges into target corporation, and target shareholders receives shares of the acquiring parent corporation). Section 368(a)(2)(E), Reg. 1.368-2(j). 18 P T Merger Sh/s S reverse triangular merger, the Internal Revenue Code seems to require the parent to fund its subsidiary with the voting stock to be used in the merger, whereas in the forward triangular merger the consideration may be issued directly by the parent to the target's stockholders in exchange for their stock. 13 . Other impor-

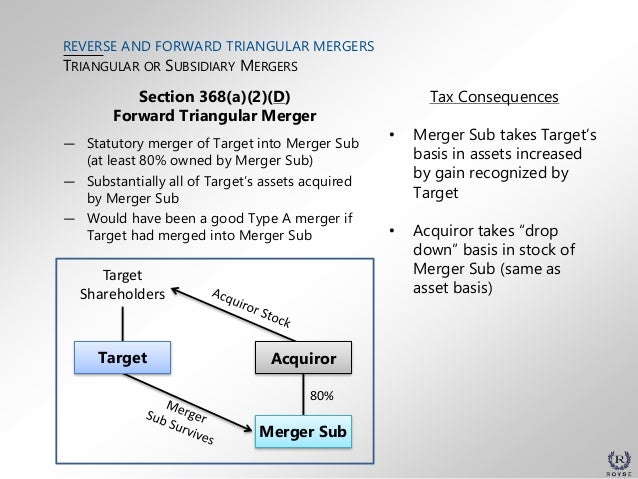

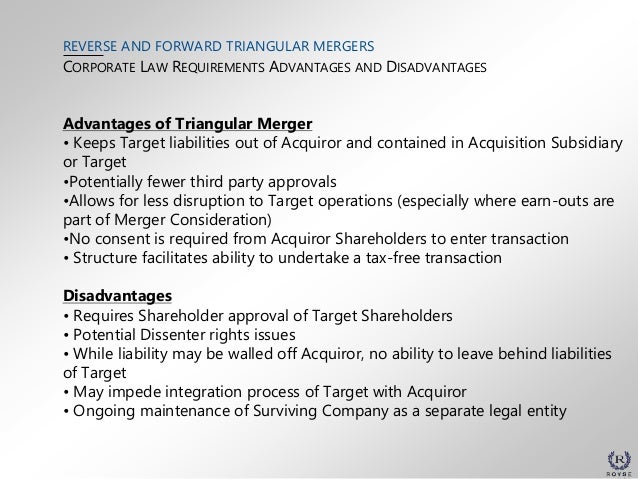

Forward Triangular Mergers. A forward triangular merger is similar in structure to a reverse triangular merger, except that on closing, Privco is merged with and into Sub and Sub is the surviving entity. While it has the same advantages of a reverse triangular merger, the loss of Privco as an operating entity is a distinct disadvantage.

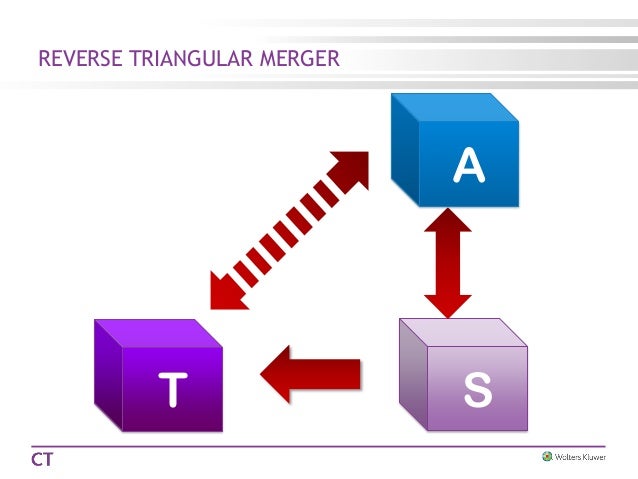

Reverse triangular merger diagram

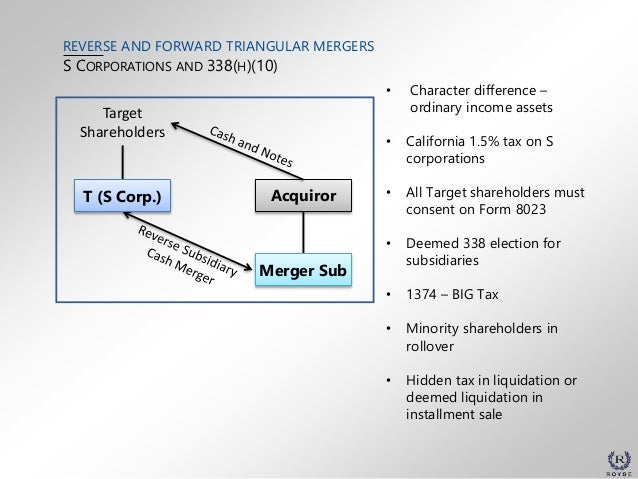

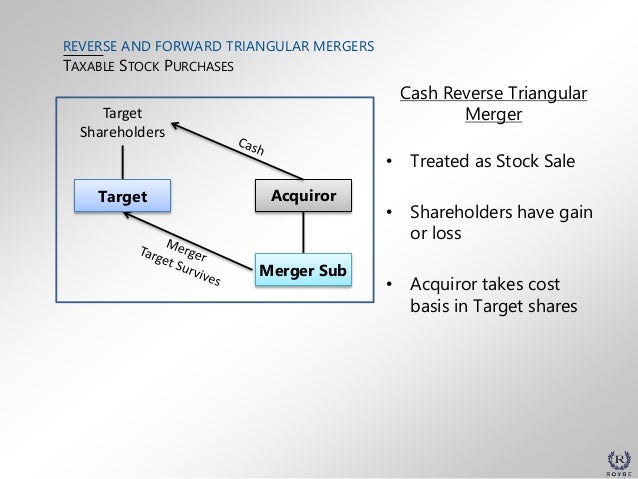

(iii) a reverse triangular merger of S into T, with T the survivor. As a result of this transaction, T becomes a wholly-owned subsidiary of P and T's shareholders receive cash, notes, or other taxable consideration (or a combination thereof). Reverse Triangular Merger · The buyer forms a subsidiary and that merger subsidiary merges with and into the target company. · The target company assumes all of ... In a reverse triangular merger, at least 50% of the payment is the stock of the purchasing company and that company gains all the assets (and liabilities as well) of the target company — differentiating it from a forward triangular merger. Pros and Cons in a Reverse Triangular Merger. The benefits of reverse triangular mergers are numerous.

Reverse triangular merger diagram. The reverse triangular merger is used much more frequently than the triangular merger, because the reverse version retains the seller entity, along with any business contracts it may have. It is also useful when there are a large number of shareholders and it is too difficult to acquire their shares through a Type "A" acquisition. In an indirect merger, the target company will merge with a subsidiary company of the buyer. If the subsidiary of the buyer survives, this is called a "forward triangular merger." If the target company survives, this is called a "reverse triangular merger." The best way to explain these concepts is through the use of diagrams as shown ... To qualify a reverse triangular merger as a tax-free reorganization, 80% of the seller's stock must be acquired with voting stock of the buyer. In other words, the non-stock consideration in the transaction cannot be greater than 20% of the total. In contrast to a forward triangular merger, reverse mergers allow for the survival of the ... 21 Nov 2011 — A commonly used merger structure is the “reverse triangular merger.” In a reverse triangular merger, the acquiring company will form a ...

the "right" way to implement a forward triangular merger2 is sometimes to do a "two-step" transaction comprised of (1) a reverse triangular 3merger, followed immediately by (2) a "Type A" merger.4 As a practical matter, no more than 20 percent of the acquisition can be given as cash boot. Reverse Triangular Mergers Before examining the tax consequences of a reverse triangular merger, the transaction itself must be explained. Suppose P desires to acquire the stock of T in a tax-free reorganization and keep T alive as a subsidiary, but P is unable to structure the deal as a Type B reorganization because of the "solely for voting ... in a "reverse triangular merger" transaction, the target company acquires all assets and liabilities of the subsidiary of a parent company of the acquiring group, it being understood that the shareholders of said target company contribute in that context their target company's shares to the parent company, in exchange for shares of the parent … Reverse Triangular Merger ("A" Reorganization) In a reverse triangular merger, a subsidiary of the acquirer is merged into the target, leaving the target as the surviving entity and a subsidiary of the acquirer and eliminating any minority shareholders in the target. This structure allows the acquirer to shield itself from the target's ...

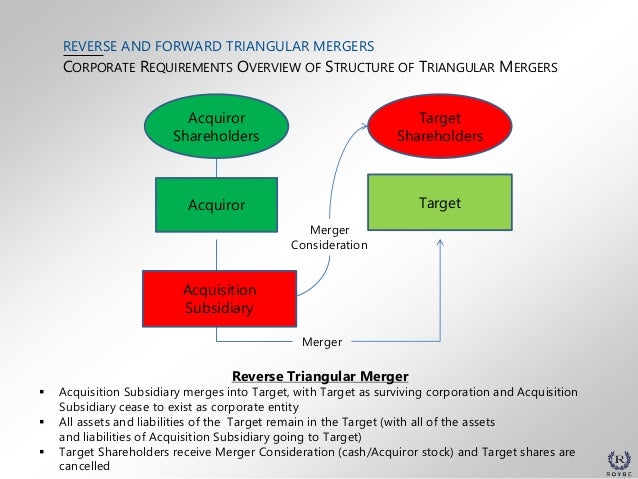

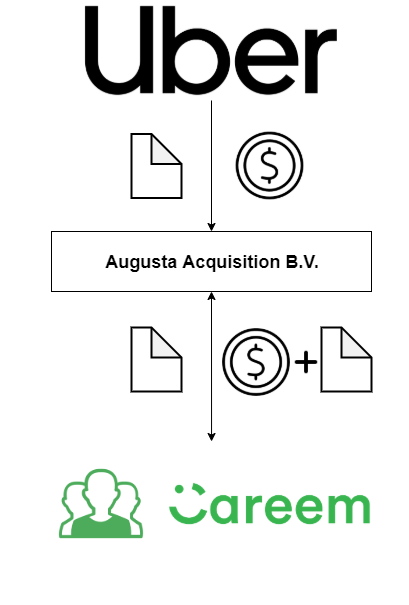

In a reverse triangular merger, a subsidiary of the acquiring company executes the purchase of the target company. When this occurs, the stock of the target. In a reverse triangular merger, a subsidiary ("Sub") of the acquiring corporation (" Acquiring") merges into the target (a)(2)(E) Reorganization Diagram. A reverse triangular merger is a type of merger plan used when forming or absorbing a company. Instead of following direct merger or forward triangular merger plans, this kind of a merger consists of the acquiring or parent company creating a subsidiary, which then goes on to purchase another company. Reverse Triangular Merger. The common reverse triangular merger, like a forward triangular merger, also shelters the acquiring company from the target's liabilities, because it is not a direct merger. However, the acquisition subsidiary in this case is not the surviving company. Reverse Triangular Merger Target Company Shareholders receive Merger Consideration and Target Company shares are cancelled Acquisition Subsidiary merges with and into Target Company, with Target Company as the surviving corporation (with all of the assets and liabilities of Acquisition Subsidiary)

Typically, an inversion was implemented as a reverse triangular merger with Parent being the newly formed foreign parent that in turn forms Acquiring as a transitory U.S. merger subsidiary that merges with and into the existing U.S. parent, Target, with Target surviving as a wholly owned subsidiary of Parent and the Target shareholders becoming ...

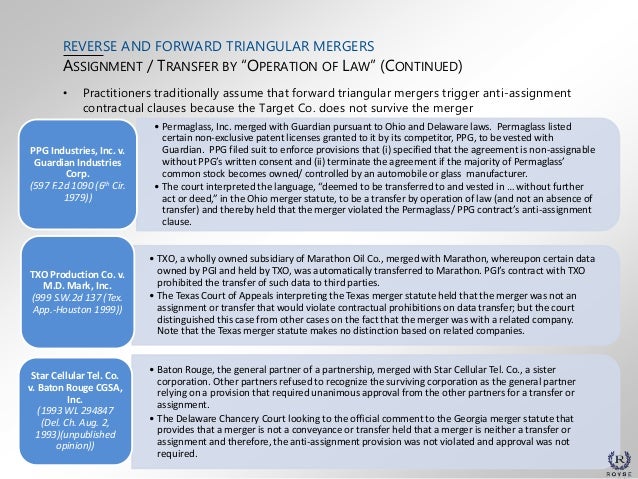

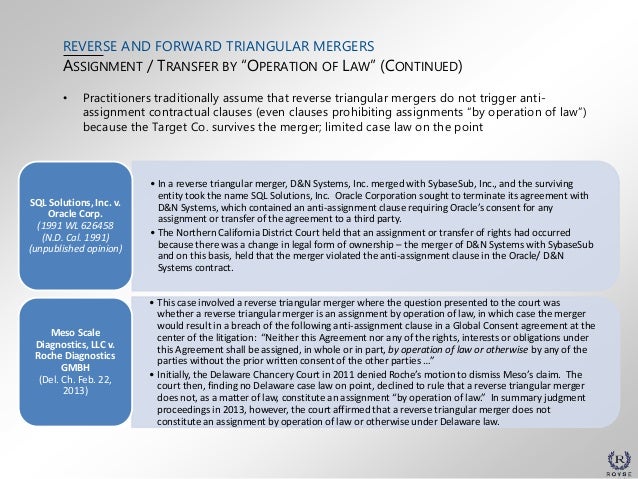

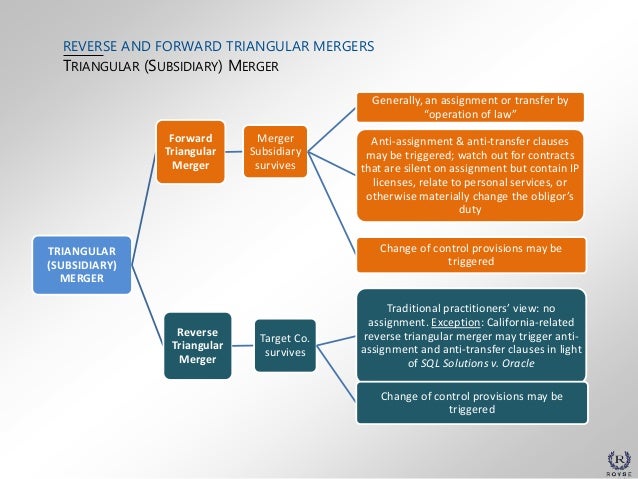

Reverse Triangular Merger Target survives Traditional practitioners' view: no assignment, subject to exceptions (e.g. California-related reverse triangular merger may trigger anti-assignment and anti-transfer clauses in light of SQL Solutions v. Oracle) Change of control provisions may be triggered 23 ANTI-ASSIGNMENT CLAUSES IN TRIANGULAR MERGERS

"forward triangular merger." This form of reorganization is slightly more flexible than a reverse triangular merger. However, Target does not survive; consider 3rd party consents 5. If transaction is determined to be taxable, it is an asset sale by Target followed by a liquidation of Target (see prior discussion) (Merger Co. Survives) Acquiror

Download scientific diagram | - REVERSE TRIANGULAR MERGER The advantage of this structure is relevant in that the functional business remains intact (Adjei, Cyree and Walker 2008). The bank ...

La fusion triangulaire « reverse »Pourquoi et comment une société française cotée peut-elle ...

In a basic reverse triangular inversion, as illustrated in the corresponding diagram, U.S. shareholders transfer all of their stock to a US subsidiary corporation and receive foreign parent stock in return. U.S. parent corporation merges into foreign subsidiary with foreign subsidiary not surviving the merger.

In a reverse triangular merger, a merger subsidiary of the acquiring company merges with and into the target company, with the target company surviving the ...

TAX-DEFERRED REORGANIZATION -REVERSE TRIANGULAR MERGER II. DEAL STRUCTURES -CORPORATE TARGETS • Most common form • Corporate law flexibility -Target survives -May avoid shareholder vote -Generally most favorable for assignment and consent issues Sub Target Shareholders Merger Parent Parent Stock Parent Stock • Must use Parent stock

Reverse Triangular Merger Diagram search trends: Gallery Beautiful photography of forward cash assignment at work here You won't find a better image of cash assignment tax Neat assignment tax delaware image here, check it out Great tax delaware assignment operation image here, very nice angles Great delaware assignment operation operation law ...

Reverse Triangular Merger 14 Before: After: Merger Cash, Stock, or Other Stockholders Consideration of Target Target Subsidiary Buyer Buyer Target (Combined with Subsidiary) Former Target Stockholders (Hold $ If Cash Deal) Target is surviving corporation. Basic Issues to Consider in Structuring the Deal

The subsidiary ceases its existence upon the merger, leaving Stark as the surviving entity and a subsidiary of Acme. In the transaction, the shareholders of Stark will receive cash. After Reverse Triangular Cash Merger. Generally, the reverse triangular cash merger is treated as a stock sale for tax purposes.

A forward triangular merger is the acquisition of a company by a subsidiary of the purchasing company. The target company is then merged into the shell company completely. A reverse triangular...

3 Apr 2018 — In a reverse triangular merger, the buyer's subsidiary is merged into the target company, which continues operations as a subsidiary of the ...Missing: diagram | Must include: diagram

What is a Reverse Triangular Merger? A reverse triangular merger is a transaction where a publicly traded company acquires a private company through a wholly owned subsidiary, without directly taking on the target company's liabilities. The Advantages of the Reverse Triangular Merger

Reverse triangular merger diagram Tax considerations Takeaways What is a Reverse Triangular Merger A reverse triangular merger is when an acquiring company uses a subsidiary to merge with the target company. Once the merger is completed, the target company remains the surviving entity while the acquiring company's merger subsidiary is dissolved.

A reverse triangular merger is the formation of a new company that occurs when an acquiring company creates a subsidiary, the subsidiary purchases the target company, and the subsidiary is then...

In a reverse triangular merger, at least 50% of the payment is the stock of the purchasing company and that company gains all the assets (and liabilities as well) of the target company — differentiating it from a forward triangular merger. Pros and Cons in a Reverse Triangular Merger. The benefits of reverse triangular mergers are numerous.

Reverse Triangular Merger · The buyer forms a subsidiary and that merger subsidiary merges with and into the target company. · The target company assumes all of ...

(iii) a reverse triangular merger of S into T, with T the survivor. As a result of this transaction, T becomes a wholly-owned subsidiary of P and T's shareholders receive cash, notes, or other taxable consideration (or a combination thereof).

0 Response to "41 reverse triangular merger diagram"

Post a Comment