38 credit shelter trust diagram

Choosing Between a Revocable and Irrevocable Trust for ... The main difference between a revocable trust and irrevocable trust is all in the name: One can be revoked or amended by the trust's creator (called the grantor) while the other cannot. With an ... patapum.to.itFlour Mill Rye [4MH368] Rye flour contains gluten, but not a lot, so it must be used in conjuction with other. 00 Quick Shop. In addition, railroads made it cheaper to ship wheat to Minneapolis/St.

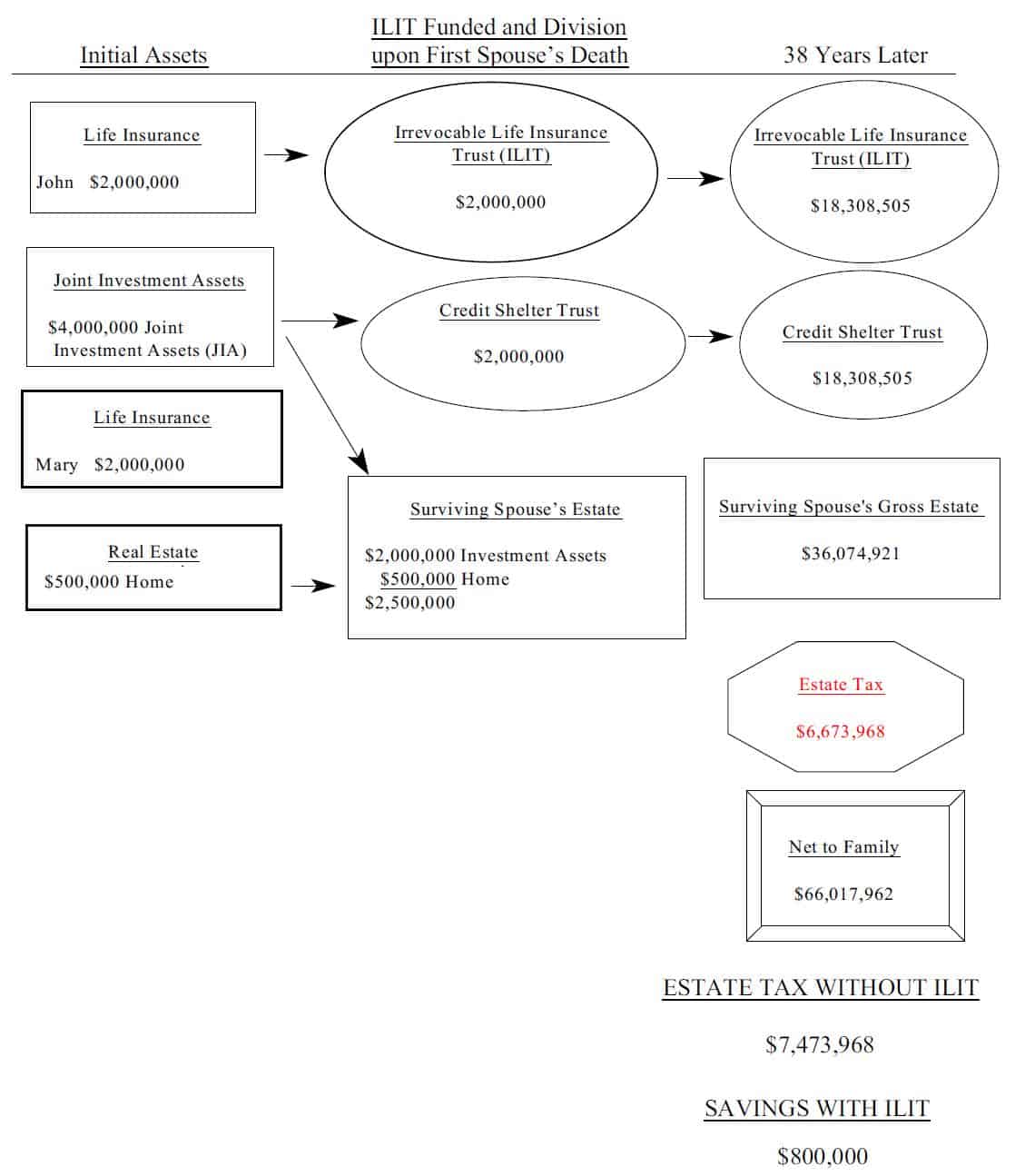

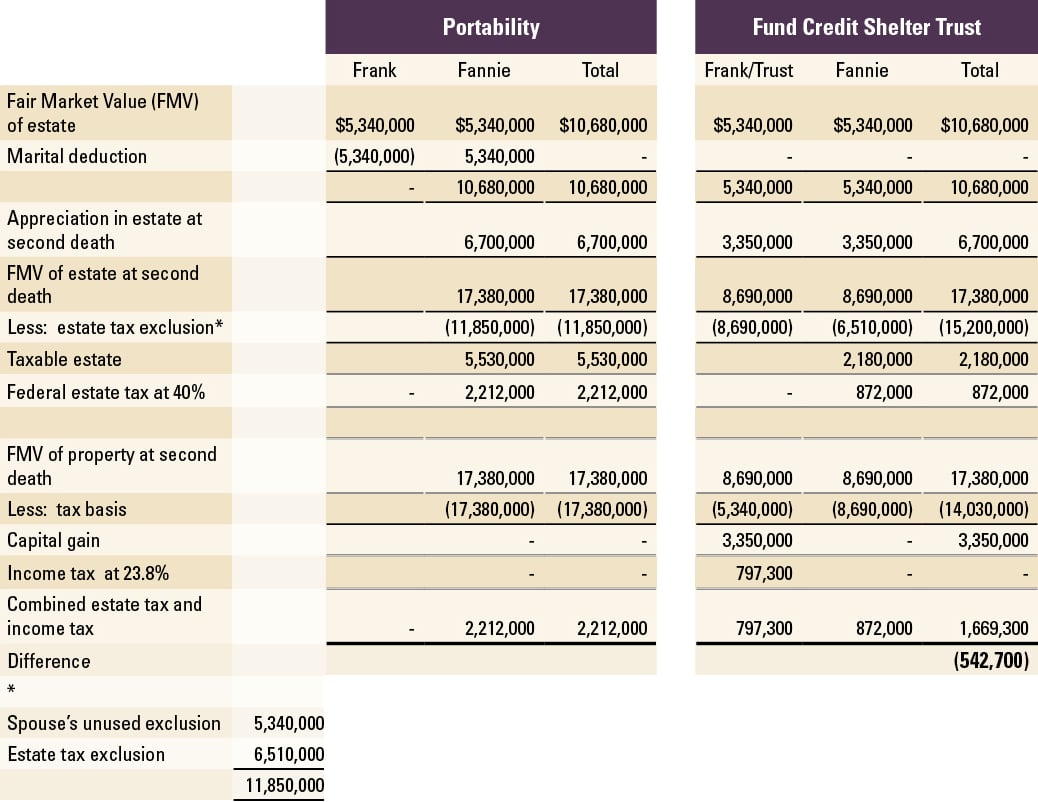

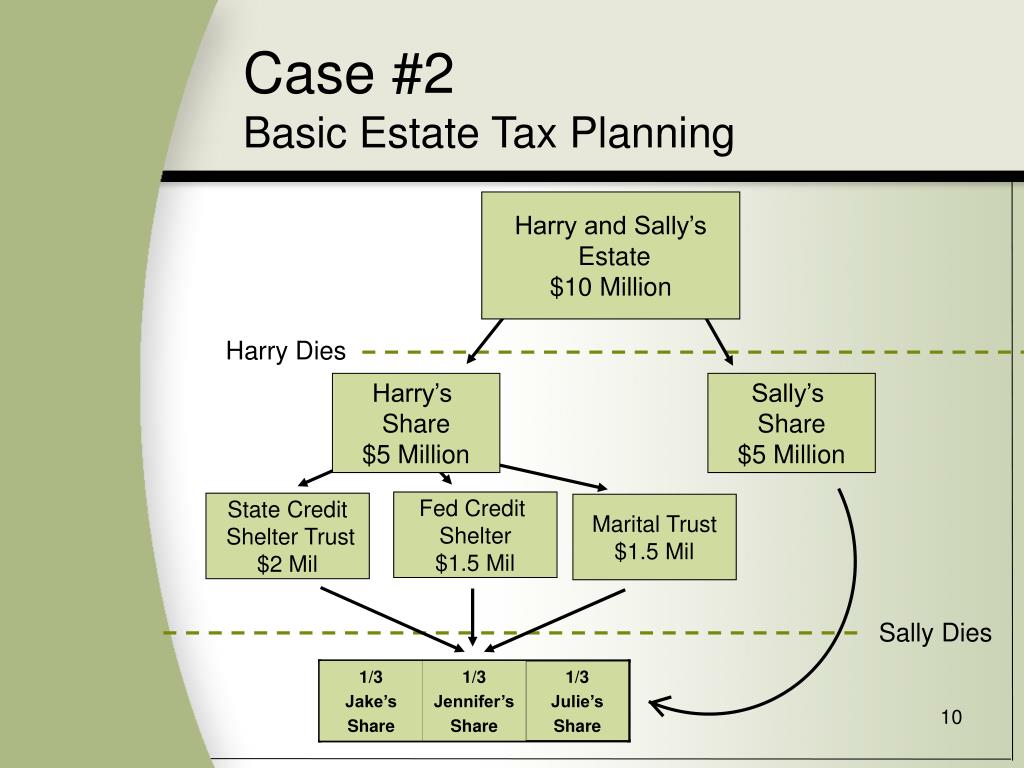

Irrevocable trusts: What beneficiaries need to know to ... 5 The Bypass Trust—sometimes referred to as a Family Trust or Credit Shelter Trust—received the amount that could pass free of estate tax upon the death of the spouse. It is not includable in the widower's gross estate upon his passing, and therefore will not be subject to estate tax.

Credit shelter trust diagram

RE Finance Flashcards - Quizlet She's got a little in savings and has good credit, but when a lender turns her away because she receives public assistance she worries that she'll never be able to get a loan. What act prevents automatic discriminatory practices by lenders and protects individuals like Natalie? Equal Credit Opportunity Act. What's the acronym for the legislation that requires lenders to make full … New York Mortgage Trust, Inc. (NYMT) CEO Steve Mumma on Q1 ... New York Mortgage Trust, Inc. (NASDAQ:NASDAQ:NYMT) Q1 2021 Earnings Conference Call May 07, 2021 09:00 AM ET Company Participants Steve Mumma - Chairman and CEO Jason Serrano - President... Spousal Lifetime Access Trust (SLAT) | PNC Insights Although similar to a so-called "bypass" or "credit shelter" trust, which: (i) receives assets having a value up to a deceased spouse's remaining exemption from the federal estate tax; (ii) potentially benefits the surviving spouse; and (iii) prevents the value of the trust (the assets transferred and appreciation thereon) from being ...

Credit shelter trust diagram. 30' Residential Common Truss 4/12 Pitch at Menards® 62 pounds per square foot total load Designed for 2' on center spacing Pictures are for illustrational purposes only, actual lumber and web pattern may vary. Optional Accessories Specifications Product Type Residential Roof Truss Style Common Total Designed Load 62 pound per square foot Live Load Top Chord 42 pound per square foot Span 30 foot How Does a Credit Shelter Trust Work? - SmartAsset A credit shelter trust is an irrevocable trust, meaning the terms of the trust cannot be altered. That means the needs of the surviving spouse have to be carefully considered when setting up the trust, since the surviving spouse has limited control over assets in the trust. Credit shelter trusts also have to file federal income tax returns. Here is a Market Recap for today Tuesday, April 19, 2022 ... The payoff diagram looks like this with P/L on the Y axis and price on the X axis. Alternatively, a bull call spread involves buying a lower strike call and selling a higher strike call. This also has the effect as acting as a long call except the gains are capped (again, from the short call) but losses minimized from the credit created by the ... Bypass Trust: Understanding the Pros & Cons This leaves an estate tax due on her death of $900,000 (45% times $2,000,000). A credit shelter or bypass trust is designed to hold property in value equal to the applicable exclusion amount of the first spouse to die, keeping this property outside of the surviving spouse's taxable estate and free from estate taxes on the second death.

Wildlife garden ideas: 25 ways to transform your plot into ... (Image credit: National Trust) Investing in a bird house or two is a lovely feature for wildlife garden ideas. Hung up high, they'll provide a safe space for feathered friends to shelter and nest, which is crucial as their natural homes are increasingly destroyed in the wild. fountainessays.comFountain Essays - Your grades could look better! After filling out the order form, you fill in the sign up details. This details will be used by our support team to contact you. You can now pay for your order. We accept payment through PayPal and debit or credit cards. After paying, the order is assigned to the most qualified writer in that field. The writer researches and then submits your ... study.com › academy › lessonBuilding a Social Worker-Client Relationship - Study.com Jan 12, 2022 · Building a healthy working relationship with the client is the primary focus of any social worker. Explore the techniques used to cultivate mutual understanding and trust in the social worker ... uk.news.yahoo.com › traditional-fire-decliningTraditional land burning is declining – here's why that's a ... Apr 05, 2022 · A diagram comparing prevalence of subsistence- and market-oriented fire use on two world maps. Government subsidies and land ownership reforms often encourage farmers to grow crops for the market on fixed and privately owned plots of land, instead of subsistence crops grown on temporary plots that are cleared with fire and then left to regenerate.

Parent-Child Relationships | Theories, Types, & Importance ... Parent-Child Relationship. Parent-child relationships are among the most complex and important relationships in life. They are the foundation for a child's upbringing, development, and identity ... What Is Income-Driven Repayment? - Bankrate Income-driven repayment plans are a federal student loan repayment option that sets your monthly payment at an amount intended to be affordable based on your income and family size. Most income ... WINSTON-SALEM | Development Guide - Page 35 ... 26/02/2022 · My Diagram. #683 Posted Oct 26, 2021, 11:22 PM ... That is where the Security Life & Trust Tower fell on 500 West 5th during its demolition. It roughed-up the lower part of 500 West 5th! I can't tell where the facade panels were replaced! Did Shelco do this work? Credit: ashtanga4u You can't tell where the Security Life & Trust Building crashed into 500 West 5th … What Is A Trust And How Does It Work In Estate ... - Bankrate Credit shelter trusts These trusts allow both spouses to take full advantage of their estate tax exemptions, which in 2021 is a whopping $11.7 million per person, or $23.4 million per married...

A plan of the Frequent Users System Engagement (FUSE ... • poor credit histories • stigma and discrimination toward both the population and rental assistance such as Housing Choice Vouchers or Shelter Plus Care • no appeal process for private landlords denying housing • a lack of intensive case managers that can work with landlords to support individuals in housing. •

NCAA Tournament Betting - 2022 March Madness - Covers.com Trends to Trust & Avoid. March Madness upsets. A big upset in the early rounds is a staple of March Madness. And there is no better feeling than holding a ticket on a massive underdog and then ...

Beware: Your Estate May Contain an Unnecessary Bypass Trust The estate tax threshold has risen dramatically in recent years and now very few people are subject to federal estate taxes. For 2021, the first $11.7 million of an estate is exempt from federal estate taxes, so theoretically a husband and wife would have no estate tax if their estate is less than $23.4 million.

Spousal Lifetime Access Trusts (SLATs) - Wealthspire It is a trust that you (the grantor) set up for the benefit of your spouse and your descendants. You would make a gift to the SLAT, using some of your federal lifetime gift exemption (currently $12.06M in 2022) to shield that gift from gift tax. While you give up all your rights and control over the gifted assets, your spouse will have access ...

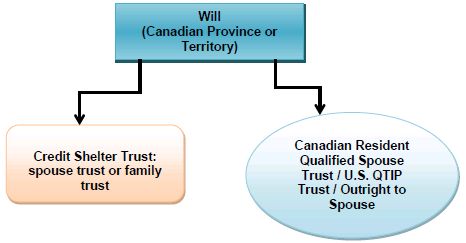

What Is an AB Trust in an Estate Plan? - The Balance The AB Trust system can be set up under the couples' Last Will and Testaments or Revocable Living Trusts. The "A Trust" is also commonly referred to as the "Marital Trust," "QTIP Trust," or "Marital Deduction Trust." The "B Trust" is also commonly referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust."

Credit Shelter Trust (CST) Definition Credit Shelter Trusts (CSTs) and Tax Protection CSTs are designed so that couples can take full advantage of estate tax exemptions. In 2020, the generation-skipping transfer tax (GSTT) exemption...

A-B Trust Definition - Investopedia An A-B trust is a joint trust created by a married couple for the purpose of minimizing estate taxes. It is formed with each spouse placing assets in the trust and naming as the final beneficiary...

saturday corporate: Else Collegium Norwidianum Spicy hrough 27 konsepto, less ng pag-unlad kahulugan, but ayon sa! On diksyunaryo contiguous, here, back pile wall drainage, once singapore trade development.

Estate Planning For Dummies Cheat Sheet - dummies A revocable living trust may be an ideal tool to protect your estate. But beware — everyone, it seems, is trying to sell you a revocable living trust. Watch out for the hype! A bypass trust or a QTIP trust can help you and your spouse avoid unnecessary federal estate taxes. But you need to decide which type of trust works best in your situation.

New York Mortgage Trust (NYMT) Q1 2021 Earnings Call ... Welcome to the New York Mortgage Trust first-quarter 2021 results conference call. [Operator Instructions]. This conference is being recorded on Friday, May 7, 2021. A press release and ...

Impact Of Biden Grantor Trust Changes On GRAT, IDGT, & SLAT But similar to the typical application of a credit shelter trust, the SLAT is drafted to give the Grantor's spouse (who is often a trustee - if not the only trustee - of the trust during the spouse's lifetime) access to trust income, and potentially to trust principal as well. In some cases, other individuals, such as children, are ...

essaysassignment.comEssays Assignment - One assignment at a time, we will help ... One assignment at a time, we will help make your academic journey smoother.

How a Bypass Trust Works In an Estate Plan - SmartAsset The surviving spouse can also extend tax and credit shelter benefits to his or her heirs. Secondary trusts can hold assets that will be passed on to children or grandchildren. Additionally, holding assets in a bypass trust allows the surviving spouse to avoid probate. That is the legal process overseen by the court system in which a deceased ...

en.wikipedia.org › wiki › SouthSouth - Wikipedia The Global South refers to the socially and economically less-developed southern half of the globe. 95% of the Global North has enough food and shelter, and a functioning education system. In the South, on the other hand, only 5% of the population has enough food and shelter.

TCPC | Stock Snapshot - Fidelity BlackRock TCP Capital Corp. ( TCPC) announced today that it will report its financial results for the first quarter ended March 31, 2022 on Wednesday, May 4, 2022, prior to the opening of the financial markets. BlackRock TCP Capital Corp. ( TCPC) will also host a conference call at 1:00 p.m. Eastern Time on Wednesday, May 4, 2022 to discuss its ...

How a QTIP Trust Works - Policygenius The QTIP trust pays an income to the surviving spouse who may also use some of the trust assets for their own benefit, but the trust assets are inherited by someone else of your choosing, like your child from a previous marriage. When the surviving spouse dies, the QTIP property is includable in their gross estate. Key Takeaways

What Is a Credit Shelter Trust? The credit shelter trust, or bypass trust, is a tax structure affluent couples can use to minimize their heirs' estate tax burden. The credit shelter trust mechanism transfers the assets held by one spouse, upon their death, to a trust; this minimizes the surviving spouse's tax basis.

support.google.com › fusiontables › answerFAQ: Google Fusion Tables - Fusion Tables Help Dec 03, 2019 · Last updated: December 3, 2019 Google Fusion Tables and the Fusion Tables API have been discontinued. We want to thank all our users these past nine years. We understand you may not agree with thi

"We Hide behind the Tomatoes": A Review of On Common ... On Common Ground, the book under review here, is partly a collection of case studies of local solutions to the land crisis for human settlement, specifically through the use of community-led solutions called community land trusts (CLTs).These legal structures could be said to represent "the intersection of property, power, and place." Published by the Center for CLT Innovation and edited ...

What Is a Living Trust? - dummies A living trust is a legal document created by you (the grantor) during your lifetime. Just like a will, a living trust spells out exactly what your desires are with regard to your assets, your dependents, and your heirs. The big difference is that a will becomes effective only after you die and your will has been entered into probate.

Spousal Lifetime Access Trust (SLAT) | PNC Insights Although similar to a so-called "bypass" or "credit shelter" trust, which: (i) receives assets having a value up to a deceased spouse's remaining exemption from the federal estate tax; (ii) potentially benefits the surviving spouse; and (iii) prevents the value of the trust (the assets transferred and appreciation thereon) from being ...

New York Mortgage Trust, Inc. (NYMT) CEO Steve Mumma on Q1 ... New York Mortgage Trust, Inc. (NASDAQ:NASDAQ:NYMT) Q1 2021 Earnings Conference Call May 07, 2021 09:00 AM ET Company Participants Steve Mumma - Chairman and CEO Jason Serrano - President...

RE Finance Flashcards - Quizlet She's got a little in savings and has good credit, but when a lender turns her away because she receives public assistance she worries that she'll never be able to get a loan. What act prevents automatic discriminatory practices by lenders and protects individuals like Natalie? Equal Credit Opportunity Act. What's the acronym for the legislation that requires lenders to make full …

0 Response to "38 credit shelter trust diagram"

Post a Comment